Who might be happy after a stockmarket crash?

Familiar with my services?

If you are, and you know this particular lifetime license is right for your business, click here to buy it

Have you considered my NEW ‘All Insights Pass’?

If you’re new here, consider my ‘All Insights Pass’ before you buy this single Insight license.

The All Insights Pass allows you to use all of my current and future Insights in your business, in exchange for one low monthly fee.

And, as with all my licensed Insights, the content updates and upgrades are included in that fee.

What’s covered on this page?

For this Insight: ‘Who might be happy after a stockmarket crash?’, I’ll answer these six questions:

- What will your audiences learn?

- How could this content help your business?

- Is this Insight Evergreen? Will it last a long time?

- Can you use it outside of the UK?

- What assets do you receive when you license this Insight?

- How does the cost of this license compare to creating this Insight in-house?

If you have other questions about this particular Insight or my services in general, email me at hello@paulclaireaux.com or book directly into my diary here.

1. What will your audiences learn from this insight?

Start by reading this Insight about ‘Who might be happy after a stock market crash’

It’s designed to help investors of all ages understand the paradox of investing—where stock market crashes can (simultaneously) be good news for some people and miserable for others!

Most people might think this sounds impossible, but you and I know it’s the arithmetic reality of pound-cost averaging and savaging (or sequence-of-returns risk).

So, this Insight explains, in plain English for non-financial experts, how:

- Our experienced investment returns can differ from the average annual return on our investment funds over time, when we make regular payments into or take withdrawals from an investment plan.

- It’s only when investing a lump sum for growth that we should expect our experienced rate of return to match the average annual return on our fund – after charges.

- The price of Investment funds with the potential for high returns may occasionally rise or fall by a significant amount, and such price moves can have a big effect on our experienced returns.

- If an investment fund price rises quickly before levelling out:

- An investor withdrawing income may enjoy a magical return.

- Someone making regular investment contributions may experience a return that’s lower than the average annual return of their fund.

- If, on the other hand, an investment fund price crashes early on and later recovers:

- An investor withdrawing income may rapidly and seriously deplete their funds.

- While the regular investor will likely be delighted by the boost to their returns, due to the extreme case of pound cost averaging!

The conclusion, of course, is that advice is vital when planning to invest.

2. How could this Insight help your business?

By sharing compelling and audience-relevant educational Insights, you can:

- Demonstrate your warmth and competence to build trust before you meet potential clients.

- Generate more suitable enquiries for your services.

- Reduce the need for costly push marketing activities, such as advertising.

- Save yourself (and clients) valuable time at the onboarding, advice and review stages of your service.

- Raise your prospects’ awareness of the value of your services.

- Minimise some key business risks.

In fact, there are 25 general benefits of education-first marketing, all listed here.

And those are on top of the specific benefits to your audiences of grasping the concepts in this Insight.

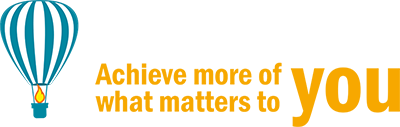

In short, this Insight will bring (or keep) your audiences closer to YOU, by giving them a better view of the value of your advice. And that’s what all my Insights are designed to do – as shown here.

3. How could you use this Insight in your business?

After buying this license, you’ll have immediate access to the text and image files, and you’re then free to:

- Produce the Insight in multiple formats: blog posts, presentation slide decks, videos, or PDF guides as downloadable lead magnets.

- Apply your firm’s formatting style, colours, logo, etc.

- Describe your role (planner, adviser, coach, wealth manager, etc.) in your preferred way.

- Remove or change the images if needed – provided this does not change the messages. I suggest you use in-post images, because they significantly boost engagement.

- Add your own ‘call to action’ messages to direct readers to seek your help in your preferred way – via telephone, e-mail, chatbot, or enquiry form.

- Remove any links to related Insights – if you don’t wish to offer those.

- Add a regulatory warning if your compliance manager says it’s necessary, given that this content is generic education, not a financial promotion.

Instructions on preparing these Insights for use in your business are included with the pack you download after purchasing the license.

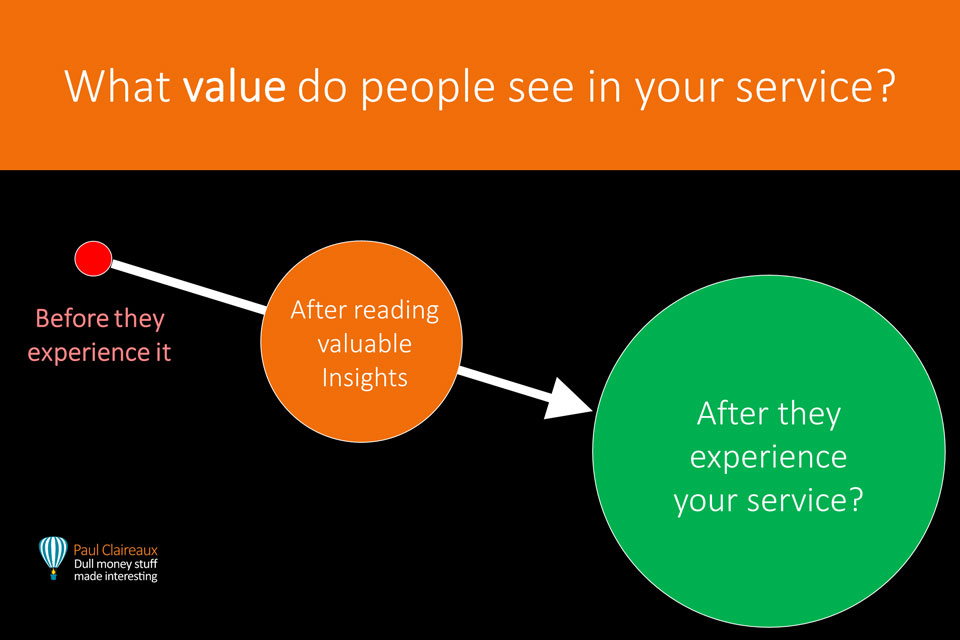

Do you need *custom-made* content for your business?

If you believe you might want to change this Insight, please book a meeting to discuss this before purchasing a license.

Image changes and minor text edits that do not affect any message should be OK, but please check with me first if you want to change this content.

I spend an enormous amount of time researching and crafting these Insights, which have been checked by a highly qualified financial planner who used to mark the IFP (now CISI) exam papers.

So, this Insight is not a rough draft. And I want to protect your reputation (and mine) by maintaining the integrity (accuracy and balance) of this content.

I’m happy to discuss working with you to create custom-made works, including unique derivative versions of any Insights I offer now—or have planned for the future.

Derivative works give you the best of both worlds. The insights are tailored to your needs and ideas, but you still save 50% to 85% on the cost of creating similar content in-house.

Here’s how this works:

We’d just need to meet online to agree on how we could work together.

So book a meeting here if you’d like to do that.

3. How evergreen (long-lasting) is this Insight?

Most of the messages in this Insight are Evergreen, so they will not be affected by changes in tax or interest rates, stock market prices, or the winds of political or economic change!

In the few areas where updates may be required, I’ll amend the Insight and issue the new version free of charge to all license holders. If you spot any information that you feel needs updating, feel free to notify me, and I’ll update those points ASAP.

I may also enhance this Insight in the future, and such upgrades will also be made available to all license holders free of charge.

4. Where in the world can you use this Insight?

This Insight is designed to help financial planners, advisers, and coaches attract, engage and retain financial planning clients worldwide.

If you’re a non-UK-based adviser or coach, you may license the content and edit any financial product or tax messages where necessary.

In the future, I hope to partner with a qualified and experienced US-based financial planner to create a US-ready set of all my other Insights. If that project interests you, please e-mail me at hello@paulclaireaux.com

5. What content assets will you receive?

After licensing this content, you’ll be sent a link to download this Insight, which comprises:

- 2,600 carefully crafted words – that’s 5% of a decent non-fiction book!

- 11 high-quality and website-optimised images to bring the Insights to life.

Images are essential for boosting engagement, whether you offer this content as written guides, blog posts, or as an educational slide deck for training your team or briefing prospective clients.

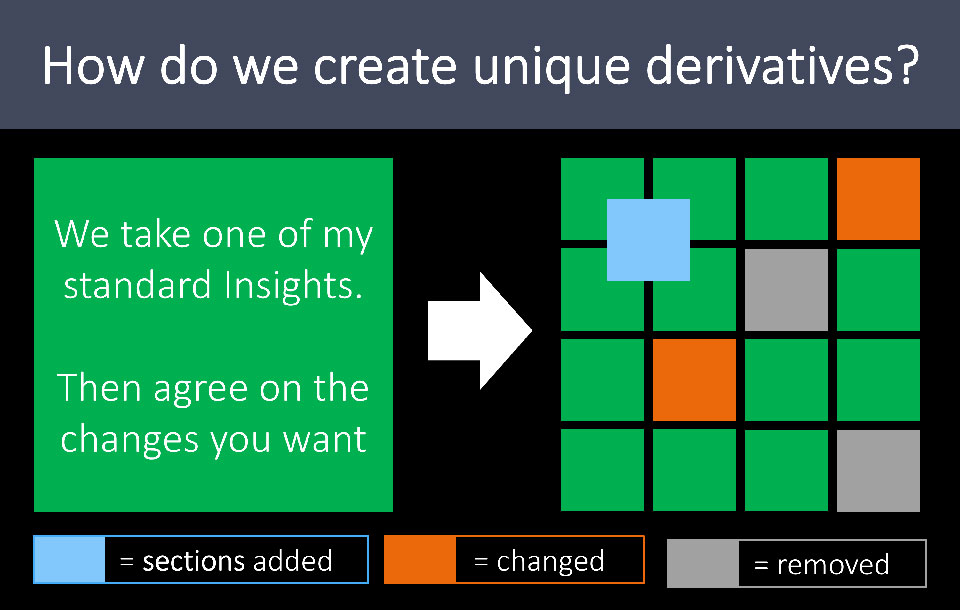

6. How much could you save with this lifetime license?

I’ve priced this lifetime license to save you between 90% and 95% of the cost of creating content of similar depth and quality in-house.

This assumes you employ a highly skilled (and financial planning-qualified) writer, and you account for their time at the average adviser rate of £200 per hour (Source: Vouched For)

Realistically, your in-house writer would need between 16 and 32 hours of intense work to create a finished Insight like this one.

So, this would cost between £3,200 and £6,400 to create in-house, and I’ve used the midpoint of £4,800 in the image above.

Double those cost estimates if your writer can earn £400 per hour on other work.

Halve them if their earnings rate is £100 per hour.

I’ve outlined why it takes so much time to create high-quality Insights in this other post.

Content creators (like authors and songwriters) work at different paces, and the pace varies with the complexity and length of the lessons.

What surprises many people is that longer works take disproportionately longer to write. And that’s because you have content structuring in addition to crafting all the key messages.

For example, this Insight on ‘Who would be happy after a stock-market crash’ took 30 hours of intense effort to create.

However, the lifetime license to use this Insight is available (with free updates) for a fee that one average adviser could earn in one hour!

Fair price?

The price shown below is for smaller advice firms

The lifetime license price on the button below applies to firms offering financial advice, planning, or coaching and employing less than eight client-facing staff.

If your firm is larger than this or you offer other financial services, please ask me to quote you a price for this license at hello@paulclaireaux.com

This license price is slightly higher for larger firms, but the pricing ensures your cost per adviser is lower than for smaller firms.

Should you try before you buy?

On this page, you’ve learned about the benefits and costs of using one of my licensable Insights.

Before you license it, however, be sure to look at my NEW ‘All Insights Pass’ which enables you to use all my current and future Insights in exchange for a low monthly fee.

I don’t mind which option you choose, as long as it offers great value to your business.

Do you need help to decide?

This bar chart offers realistic estimates of the range of costs to build or acquire a sound Insights library.

I’m happy to help you explore these options on a video call.

And I’m keen to ensure you get the best deal possible for your business from me or any content creator you work with.

If you’d like to do that, book a meeting directly into my diary here.

Happy to license this Insight?

If you’d like to use this ‘Who might be happy after a crash’ Insight in your business, you can purchase the lifetime license (with FREE updates) right here.

Return to the store