The truth about fund charges

And how much you might be paying for the management of your money

So, what is the truth about fund charges?

How much should you pay (in total) to have someone manage your money?

Let’s explore the charging secrets of fund managers and advisers.

And this has been a secret for a very long time

Did you know that it’s nearly 20 years since the UK’s Financial regulator (at that time called the Financial Services Authority or FSA) identified a big problem with investment fund charges?

They noted the, quite obvious, fact that we, the investors, could not get the information we needed to work out the cost of investing.

So, you might reasonably expect that they would have done something about that by now.

Sadly that’s not the case but there are moves afoot to improve things at some point in the future.

Of course, unless you’re sad enough to pay close attention to this (frankly boring) stuff 😉 you might have missed last week’s report on the various failings of the financial industry.

This latest report (which took nearly two years to produce) comes from the Financial Conduct Authority (FCA) – the regulatory body set up after the global financial crisis of 2008-09 to replace the old FSA.

Yes, that’s right. They changed one word in their name.

Well, they had to do something after that Global Financial Crisis debacle eh!

In fairness, the FCA does seek to improve the financial services industry for us. It just doesn’t work very fast.

So, you must always look out for the big tripwires yourself.

Just sign up to my newsletters – or join my Facebook Group below – to keep reading these Insights

Meanwhile, back at the stables . . .

Our regulator has finally come up with some ideas to change the ‘internal’ workings of the fund management industry.

And if you fancy some light bedtime reading here’s their full report

Right – thanks! but what will the regulator change?

Possibly quite a lot – but it will take time of course 😉

The bits that matter to us are:

- Getting the industry to disclose a single ‘all in’ price that we pay for our funds. The idea is to help us decide if we’re getting good value for money. And this ‘all in’ price should include any, currently hidden, charges for transactions within funds.

- Making “fund objectives” understandable – which is a quite brilliant idea! – and

- Imposing more duties on fund managers to make sure they act in our best interests.

So, this is all sensible stuff – it’s just very late in coming and still a long way from being implemented.

Okay, but will those changes fix the industry?

Well, that depends on what you mean by ‘fix’

If you expect all investment funds to be wonderful performers, clearly understandable and fairly priced . . . you’re going to be sorely disappointed.

For example, there are no proposals (that I can see) to impose any controls on the charges you pay for “closet tracking funds” – which are a large and troublesome sector of the fund management industry.

Closet trackers are classed as actively managed funds and some of them charge high fees for that ‘active’ fund management.

The trouble is that closet trackers aren’t really actively managed. They invest in pretty much the same assets as much lower cost index tracking funds.

And that’s why they’re called ‘closet trackers’

Oh dear!

Yes, oh dear. And if you’d like to learn a bit more about ‘closet trackers’ and quite a lot more about issues with their big brothers –the real Index Trackers – see here

So, whatever happens with the regulations, you’ll still need to understand whether your funds are genuinely managed and whether you’re paying a fair price for that management.

Right but what about those ‘hidden’ charges inside funds?

Well, this is where the story gets rather ‘weird’.

You see, some financial planners (and some of the most popular investment bloggers too) will tell you that ‘hidden charges’ inside actively managed funds are a massive industry problem.

And because of this ‘alleged’ issue, they say that you should only ever use low-cost Index tracking funds to invest your money.

One financial planner has even produced a funny iceberg cartoon to assert his view that most of the total costs of investing in ‘most’ actively managed funds are hidden.

He claims that total charges on actively managed funds range from 2.25% to as much as 4.75% p.a.

And that the hidden costs (the big bit of the iceberg below the water) range from 1.5% p.a. to 3.5% p.a.

Now let’s be quite clear – these are astonishing claims about hidden charges.

And if this financial planner were right – it would mean that the hidden charges on our investment funds were about ten times the levels estimated by the Investment Association (The I.A.)

The I.A claim that the, currently hidden, costs of transactions inside funds are more typically around 0.2% p.a. to 0.25% p.a.

Their data as supplied to Citywire for their article, ‘Do fund managers chop and change too much?’ is available here.

Another firm of financial planners claims that UK stock market funds (with portfolio turnover rates of 100%) have hidden charges of 1.8% p.a. And again, that’s nearly ten times the number asserted by the Investment Association.

The trouble is that neither of these financial planners has yet shown us any serious academic evidence to support their claims about these high hidden costs.

So, who’s right and does it matter?

Well, it matters a lot because if the Investment Association is right then the hidden charges in funds are c. 90% less than some financial planners are claiming.

And those charges can make a massive difference to your money over the medium to long term.

If the financial planner’s ‘scary’ story is correct . . . then you could lose all your investment growth on actively managed funds over the coming years due to hideous hidden charges.

Here’s an example:

Take a £100,000 investment in a fund earning, say, 5% p.a. ‘real’ (after inflation) returns.

Here’s what you’d lose, in today’s money terms (if inflation ran at 2% p.a.) if you suffered these alleged hideous charges of 4.75% p.a. versus more realistic charges of, say, 1.25% p.a.

- £43,000 over 10 years or

- £106,000 over 20 years

Unbelievable – right?

Thankfully, at least as far as good active fund managers are concerned, these assertions about hideously high hidden charges are misguided nonsense.

I’d certainly hope that they’re not put forward in order to persuade investing clients on their investment decisions 😉

Reputable fund managers do not charge anything like this.

The evidence comes from Gina Miller, (Yes, the lady in the Brexit News) who leads the True and Fair Campaign for transparency in fund charges. See here.

Her organisation estimates that hidden fund charges – albeit a tad higher than those stated by the Investment association – are, at least, in the same ballpark.

They calculate that hidden transaction costs for actively managed UK-domiciled funds are currently running at c.0.38% p.a.

And they also acknowledge that charges vary from fund to fund according to the amount of portfolio turnover and the costs of trading different types of security.

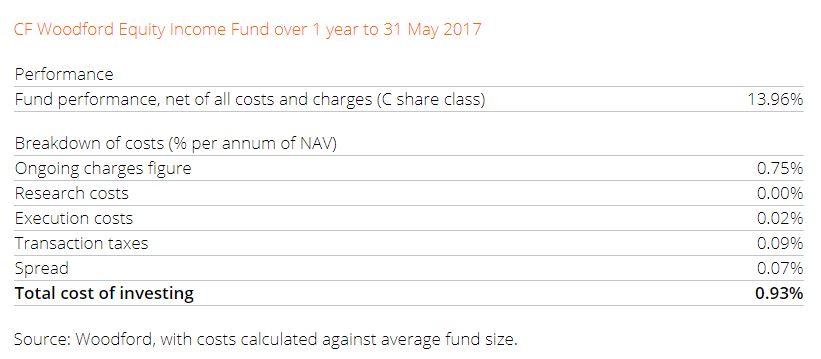

Here’s a good example of transparent fund pricing

Woodford Investment Management may have had their challenges over the past year – but they are a leader in this area of fund charge transparency.

And they make it quite clear that their research costs are included within their declared annual management charge.

They also disclose the normally hidden costs for transactions and taxes on their site – as shown here.

Their internal transactional costs are just 0.18% for the past year (0.07% + 0.09% + 0.02%) – which is even less than the Investment Association average.

So, at less than 1% p.a. ‘all in’ Woodford is offering professional money management for less than one-fifth of the cost suggested by financial planners with iceberg cartoons.

Now, this is not to say that there are no ‘dodgy’ active fund managers out there – who seriously overcharge and/or seriously over trade on their funds.

But it’s simply wrong to suggest that hidden charges for active management are 5 to 20 times the level they are in reality.

The fact is that there are some good active fund managers doing a great job at a fair price.

What’s more – there are still a good number of Index Tracking funds that seriously overcharge!

And let me be very clear on one point.

I really don’t mind which funds you choose to invest in – because I don’t sell them.

I just want you to have a firm grip on the facts to help you make more informed decisions about your money.

So, if it’s okay with you – we’ll stick to the facts on this website.

And this leads us onto financial adviser costs

What worries me is that a flawed idea of the costs of good active fund management has tempted a lot of financial advisers to ‘have a go’ at being a kind of fund manager themselves.

And I fear that it’s tempted a few others to appoint expensive, boutique discretionary fund managers to manage your money.

Either way, you’re going to pay for this local fund guidance or management service.

So, you really should find out how much you’re paying for it all.

And that includes the costs of the fund platform upon which all this fund management goes on.

Fund platforms, by the way, are next on the FCA’s investigation agenda.

But don’t expect to hear back from them on that any time soon.

Personally, I can’t think of many situations where it’s a good idea to replace a proven and respected professional fund manager with a local broker or discretionary fund manager to manage your money.

But that’s your choice.

The annual (% of fund based) charges you’ll incur for this work varies a great deal between advisers.

And it can vary according to how much money you have with them too.

In my experience, the ‘going rate’ for fund guidance type work – is about 1% p.a. and based on the value of your funds under advice (aka FUA)

Some charge more, some charge less and some stick to financial planning – and don’t get involved in this pseudo fund management type of work at all.

The essential point to note is that . . .

[clickToTweet tweet=”. . . financial advisers do not manage your investment funds for you.” quote=”. . . financial advisers do not manage your investment funds for you.”]

That job is done by the fund managers – or not done at all if you’re happy to track stock market indices – which might be right in some cases.

Fund management is a complex business and to learn more about some of the big issues of Investment Risk management – head over here

Some advisers will charge you to ‘rebalance’ your funds from time to time. And that might be necessary if you have a collection of funds (whether they’re active or tracking)

But unless you get some serious ongoing financial planning support, at an agreed level of fees, you should not be suffering a heavy ongoing charge ‘drag’ on your funds.

You can see what an ‘unnecessary’ 1% p.a. charge can do to your funds here.

And you should most definitely challenge any adviser who wants to charge you to ‘keep an eye’ on your funds and report values back to you from time to time.

That’s not a job that you need to pay for.

You can get all that information online yourself these days.

So, what should you pay for fund management and advice?

Well, when I headed up the proposition development team for a blue-chip investment house – admittedly a year or two ago now 😉 – we happily turned out investment and pension products at a ‘factory gate’ price (the price before advice charges were added) of around 0.4% p.a. (for investments of £100,000+)

And there were no front-end charges on those base products either.

The super low annual charge covered everything – other than advice – on the product.

So, it included our charges for:

- All the pre-sales material and any projections of benefits requested

- Administration of the application – applying your money to the product on our systems

- Connecting that product to a range of investment funds

- The administration, safe custody and Insurance company (Or Index tracking) fund management of those funds, and

- All basic administration services on an ongoing basis, enabling you to obtain valuations, make fund switches and, for investment bonds, the costs of taking withdrawals.

Now, I suspect that these basic products may be a bit more expensive now.

But if you ask your adviser you should still be able to get an idea of some straightforward investment and pension product prices – before advice charges are added in.

And I would be very surprised if you’d pay more than 0.6% p.a. for an investment of £100,000 or more.

What you must decide is how much more you should pay to run your investments with advice (and any ‘exotic’ fund management options – if you really need them) added in.

Once you add in annual charges for an adviser and a separate discretionary fund manager and to hold your investments on a separate administration platform. . .

. . . you can easily end up paying three times the cost of a simple base product.

Of course, that might be good value – depending on the amount you have invested and how much high-quality financial planning work you receive on top of fund management.

But with some advisers, it will simply not be worth it.

So take care out there.

Thanks for dropping in …

… if you’d like more ideas around money and personal performance, in an occasional newsletter, sign up here.

And, as a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ … and the first chapter of my book, ‘Who misleads you about money?’

Or, if you’d like more frequent ideas (and more interaction) …

And feel free to share your thoughts in the comments below.

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article