How we cause disasters

By trying to avoid them all the time

We’ve had some powerful reminders this week that big ‘natural’ disasters are completely beyond our control.

Both Hurricane Irma and the (less well covered) Earthquake in Mexico prove just how powerless we are as natural disasters unfold.

At best we can prepare to pick up the pieces after the disaster has passed.

There are however other natural systems where our well intentioned ‘protective’ actions will often cause the very disaster we wish to avoid.

Let’s explore these systems now.

Systems that collapse if you protect them

We all know that our bodies don’t ‘thrive’ if we lay in bed all day. Our muscles and bones get weaker if we avoid the minor pain of regular work or exercise.

And if we take idleness to the extreme – we’ll eventually become so weak that we’ll collapse, catastrophically, when faced with even modest exertion.

Likewise, an economy won’t thrive if we try to protect it from every single challenge in the world.

So, individuals, businesses and whole economies need to work and compete against others to get strong.

They can’t deliver real and sustainable growth if we wrap them in cotton wool and bail them out every time they mess up. They just get weak and fail.

In his excellent book, ‘Ubiquity: Why catastrophes happen’, Mark Buchanan shows us several examples of these systems.

And one of his key observations is how these systems can seem perfectly stable at one moment before suddenly collapsing altogether the next.

This is an observation that’s precisely in line with the findings of economist Hyman Minsky of course.

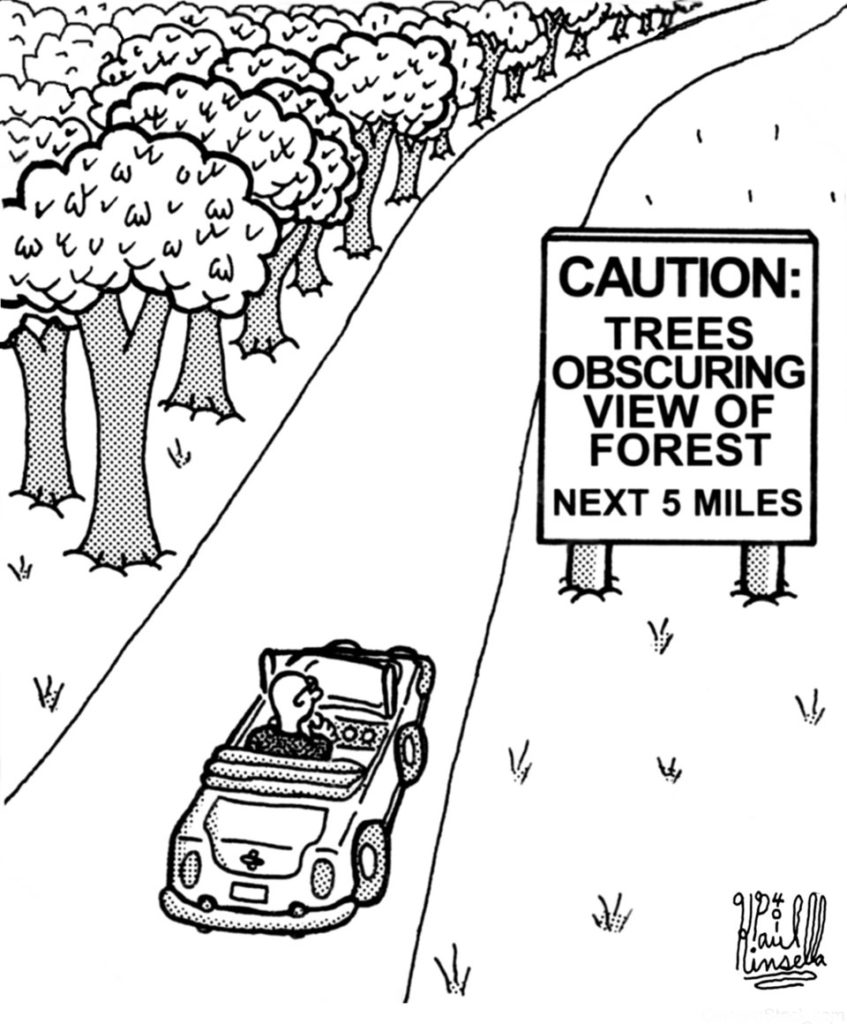

Seeing the wood for the trees

To my mind, Mark Buchanan (in his book ‘Ubiquity’) offers us the most powerful analogy for understanding how NOT to manage an economy.

And that’s to compare it to how we might manage a vast wooded forest.

In their natural state, in the absence of modern day humans, forests are still damaged by occasional fires triggered by lightning.

These frequent, small fires burn off a random patchwork of areas, clearing them of old wood and allowing space and light in to support the growth of new saplings.

And that patchwork of young green saplings – acts as a break on the spread of fires.

Unfortunately, from 1890 the US Forestry adopted a ‘zero tolerance’ policy on fires, including those sparked by natural causes.

They started to intervene and tried desperately to protect the forests from every fire whatsoever.

And as Buchanan notes:

One of the unintended consequences of this program was that the forests began aging.

Old trees were no longer getting replaced by younger trees, and the natural evolution of the forest’s materials changed.

Deadwood, grass, twigs,brush, bark and leaves accumulated

The result was that by suppressing these fires – the fire service drove the forests into a highly unstable state – what Buchanan calls a super-critical state.

‘The protected woods built up an enormous fuel load of downed and standing dead trees and limbs, flammable underbrush and grass … such that a single lightning strike or cigarette butt could explode into a mass fire.’

Now, to be clear, I’m not saying that the disaster in this video was caused by forest mismanagement over the years.

But the video does give us an idea of how uncontrollable disasters can explode from forests in a super-critical state.

There’s very little we can do to stop these enormous disasters once they take hold.

We might decide to focus our relatively ‘puny’ human effort in protecting certain assets in some places. But for the most part we can only stand and watch as they burn themselves out.

When we think of economies in this way it appears that our political and banking leaders, both in the USA and elsewhere, were very confused about what they were doing in the decades leading up to the financial crisis of 2008-09 and perhaps since that time as well.

We’ve made the same mistake – by putting out all small fires for 30 years

Most western politicians and bankers will claim that we’ve had ‘free’ markets during this time.

That our economic forest has been largely left to its natural state – and that markets have been allowed to manage themselves.

They would argue that only a light-touch of regulation was required because they knew that market participants would work in their own and our best interests to develop thriving industries.

Free markets should have burned off the dead wood and provided the environment for new saplings to sprout.

And they assumed that commercial bankers would never do anything to trigger an uncontrollable forest fire.

How wrong they were.

Not only did they misjudge the behaviour of the bankers but when the slightest trouble struck in our economy – they manipulated the price down – in one of the most important markets of all – money.

By constantly lowering interest rates – the western world’s central banks have, over decades, protected markets from the pain of competition and small recessions.

So the dead wood accumulated – in industry and particularly in the banking sector.

We’re ‘anti-fragile’

Nassim Taleb, in his book, ‘Anti-fragile’, also reminds us how economies act like many other natural systems.

He’s coined the term ‘anti-fragile’ to describe the property of a complex system that benefits from modest amounts of harmful stress or volatility.

So, this is about seeing the good in hard physical exercise – and food abstinence for humans.

It’s about understanding that we must allow some businesses to fail – if we’re to allow room for better businesses to take their place.

Of course most systems have limits to the amount of stress they can bear, and this will vary with their current condition.

It wouldn’t make sense to ask a 50-year-old obese person, who smokes 40 cigarettes a day, to set off on a marathon. But some modest increments in exercise would, over the long term, have highly beneficial effects.

Taleb also notes that in anti-fragile systems, the very large unexpected events are generally negative in their affect, whilst strengthening takes a lot of time and effort.

This was quite evident in our economic system. The banking system and our whole economy pretty much collapsed overnight in 2008.

Whilst we are only now starting to see that it could take decades before our economies recover. And that there could be more big shocks along the way – given that total world debt is higher now than during the last crisis.

So, I think we should challenge our leaders – and especially those who ‘claim’ that their priority is to protect jobs.

Is their aim to continue trying to extinguish every small problem in our economy, or can they accept that these are just necessary changes in building a stronger economy?

Getting the balance right is never easy, especially when you have an electorate to please.

But I think most people would agree that we’ve been getting it wrong for a very long time.

We don’t really understand market risk

At the heart of our problem in managing our world economy is the fact that we don’t know how to manage our banking system.

And we don’t know how to do that because we don’t understand risk.

In a nutshell, the bankers have been using the wrong mathematical models for predicting risk.

The honest truth, as Taleb says in Anti-fragile: ‘is that the odds of rare events are simply not computable.’

We don’t know what the chances are – that prices in stocks (or property) will crash.

Prices do not vary in line with the normal distribution model – despite the fact that many experts still use those models to advise you on risk today.

All we really know about asset price movements is that their frequency – relative to the size of price movement – seems to follow an inverse cube power law.

Okay, sorry, I’ve gone a bit too ‘mathematical’ here. Inverse power law … so what does that actually mean?

Well, in simple terms, it simply tells us that very large movements occur far more often than the traditional Gaussian (or normal distribution) models suggest.

So, as Mark Buchanan, in ‘Power laws and the new science of complexity management’, points out:

Financial market drops of 10 per cent in a single day should – according to a normal distribution – occur only once every 500 years.

Yet they’ve been shown to occur about once every 5 years.

This is not a trivial error in the system being used.

You might also like this funny story on how a senior finance officer at Goldman Sachs also misunderstood risk.

Power laws also describe earthquake size

Yes, it turns out that this ‘power law’ model also describes the frequency of earthquake movements – relative to their size.

But even applying a power law we find that the chances of very big events – whilst more likely than under the standard model – are still fairly rare.

So what’s the big issue?

Well, we need to remember that these probabilities are determined using very large samples of data – perhaps over 100 years or more.

Whereas I guess most of us are more interested in investing over shorter periods, albeit up to 20 or 30 years or so.

And what’s interesting is how asset markets behave very differently to the expected probabilities over shorter periods.

Very large movements – just like earthquakes and aftershocks – tend to cluster into short periods of time.

So, for example, we’ve seen two large (about 50%) falls in the UK stock market within the last 15 years.

And this is far more than would be expected, whichever model you use.

So, what clues of trouble can you look for?

Well, it’s quite clear from the data that when markets become overvalued, a big crash is far more likely.

Just as a big forest fire is far more likely if we light the match when it’s full of old dead wood – and in a critical state.

The valuation (forest dryness) starting point really matters.

It’s extremely risky to ignore the starting point in terms of valuation and to simply use average returns from the past to predict future returns.

Yet this is precisely what the banks did when they assessed their risks on those mortgage securities that blew up the financial system in 2008.

And it’s what some financial advisers do when assessing the risk in your portfolio.

You can tell which ones do this because their advice about risk usually includes the phrase ‘don’t worry be happy’

The Ubiquity of the power Law

If you’ve studied statistics at all – in science or marketing – you’ll be familiar with the simple rules of thumb that you can use (with the Guassian /normal distribution) to estimate the chances of deviations from the average return.

And that model is useful IF your data fits it.

The ‘normal’ model applies primarily to systems in which the events are entirely independent of each other, like the data you’d get from laboratory experiments – or the heights of people – for example.

However, within many living systems our outcomes are not independent of each other.

They are ‘interdependent’, which means that an event or action by one party in the system – has an affect on what the others do.

The ‘normal’ / Guassian model does NOT work here.

But the power law very often does, and it’s remarkable just how many natural and social systems are distributed according to these power laws.

In their paper ‘Why Guassian statistics are mostly wrong for strategic organisation’, Bill McKelvey and Pierpaolo Andriani listed 55 different systems in which the frequency of events compared to the scale of those events follows a power law.

They include:

- Networks in the brain

- Tumour growth

- Traffic jams

- Galactic structure

- Earthquakes

- Forest and bush fires

- Asteroid hits

- Mass extinctions

- Casualties in war

- Social networks

- Size of villages, towns and cities

- Salaries and

- Wealth

The other KEY thing to note about these systems is that the concepts of “average” and “standard deviation” are meaningless.

They provide no insights whatsoever into what the future might hold.

A grisly story about Grandma to learn the point

I had the pleasure of attending a talk by Nassim Taleb when he visited Bristol – a couple of years back – for our ‘Ideas festival’.

And he used a grisly but powerful analogy to explain this point.

Imagine that you’re looking for a room for your “Grandma” at a residential home.

The manager tells you that, on average, the rooms are kept at a nice, comfortable 20°C

Unfortunately your Grandma dies shortly after moving in.

And it’s only when you investigate what happened that you discover that whilst her room was indeed kept at 20°C “on average” – the temperature actually fluctuated wildly each day between freezing point and 40°C!

We’ve known about this problem for 50 years

Taleb acknowledges that his central message, that we measure risk incorrectly, is really not new.

It’s based largely on the thinking of Benoit Mandelbrot who proved, as far back as the 1960s, that markets don’t work in the way we’ve been assuming that they do.

Mandelbrot is famous for being the father of fractal geometry.

To learn more about him – and to hear him calmly explain this problem – to John Authers at the FT – try this article.

If your adviser still believes that markets are correctly priced at all times . . .

. . . and that risk is perfectly measurable using a normal distribution model, then I recommend that you send them a link to that article.

The really crazy thing about our problem with risk management is that we’ve understood it for a very long time.

We’ve simply chosen to ignore the facts because we hoped that we could grab more growth in the short term- by allowing a boom in borrowing.

So where are we now?

How is our economy set?

And how ‘fairly’ is property priced? – This is key because it’s this highly geared asset class that so often gets our banks into trouble.

The house price crash in the USA took their prices back to around their long-term average levels in real terms. But with interest rates held on the floor – we’ve seen prices there rushing back up again recently.

In the UK we remain a long way above our long-term average valuations – relative to incomes as you can see here.

The bottom of the last housing market crash in the UK was around 1996.

And since then we’ve enjoyed (if that is the right word) the greatest boom we’ve ever seen in house prices.

Interest rates are at ‘abnormally’ low levels – their lowest level for c. 400 years.

And with central banks having distorted free markets by keeping rates at these levels – it might take a while longer before we see forced sellers of property this time round.

That said, house prices have been ‘cooling’ rapidly in the UK of late.

We’ll only find a more sensible level for house prices – when mortgage interest rates are back at more normal levels – which could easily be twice what they are now.

My generation got it wrong

Let’s be under no illusion. Getting out of our current predicament, of having too much debt (both government and private), is not going to be easy.

For a long time, from the 1980s through to around 2007, it seemed that we’d found the secret to lifelong riches without having to do much work … or add any value to society.

That generation – my generation – got it wrong.

People were taking out additional mortgages on their homes simply to spend the money.

They treated their homes like an ATM whilst others were buying as many properties as they could to make big ‘geared’ gains.

Those days are gone and now we have a long road of debt repayment ahead.

The plan appears to be to suppress interest rates for long enough to get the economy back on its feet.

But there are some huge uncertainties around the sort of economy we’re creating.

Are we keeping too many zombie businesses alive and protected with ultra-low interest rates?

Are we yet developing enough sustainable new businesses to keep unemployment down?

And do we have enough sufficiently well qualified people to take those jobs if they’re created?

The risk of keeping rates too low for too long

A big risk is that by keeping rates too low for too long, our currency continues to fall and our import costs rise.

This has already pushed up inflation and those in work have become tired of receiving below-inflation pay increases.

If wage rises start escalating under industrial unrest, this would push inflation higher still, and we’d be into an inflationary spiral of wage push inflation.

At or before that point, our international investors – those who lend to our companies and government – might push our interest rates sharply higher, regardless of what the Bank of England does.

This would deter businesses from making the investments we want, and would make our government finances even worse – forcing more cutbacks.

Look, I really don’t take pleasure in being gloomy.

It’s just a fact that our economy remains in a fragile state. We’re not out of this ‘tinder dry forest’ just yet.

What’s more, we’ve been playing with the same mistaken game with house prices that blew all these problems up in the first place.

Using taxpayers’ money via ‘Help to buy’ to get more people who can’t afford houses to buy them.

Can I offer you some predictions?

Can I tell you when we might see the bottom of our house price cycle – or the next stock market decline?

Sadly not – and it’s worth remembering that . . .

[clickToTweet tweet=”. . . it’s really only possible to recognise a bottom after it’s gone past you!” quote=”. . . it’s really only possible to recognise a bottom after it’s gone past you!”]

But you can be careful what you buy right now – or where you’re invested if you already have money in the markets.

And you can take on board some of the warnings out there about markets overheating.

And, if you’re buying a retail investment product (A fund portfolio, a personal pension, a stocks and shares ISA or Investment bond, etc., then please read the warning on the key features document.

It will say something like this:

Past performance is no guide to future returns.

The value of investments can go down as well as up.

You could get back less than you invested.

All investments should be regarded with a long-term view.

Please take those warnings seriously and get some ‘intelligent’ guidance on market value.

All the best for now

Paul

Please share your thoughts in the comments below. I’d love to hear from you.

You can log in with your social media or DISQUS account OR To “post as a guest” – just add your name and that option will pop up.

And for more ideas and updates – straight to your inbox – click this image

I’ll also send you a chapter of my acclaimed book AND my ‘5 Steps for planning your Financial Freedom’ (absolutely FREE)

I’ll also send you a chapter of my acclaimed book AND my ‘5 Steps for planning your Financial Freedom’ (absolutely FREE)

Discuss this article