Educational Insights you can use today

This page is for financial planners, advisers and coaches.

Here you’ll find a list of consumer-facing educational Insights you can white label and use in your business today.

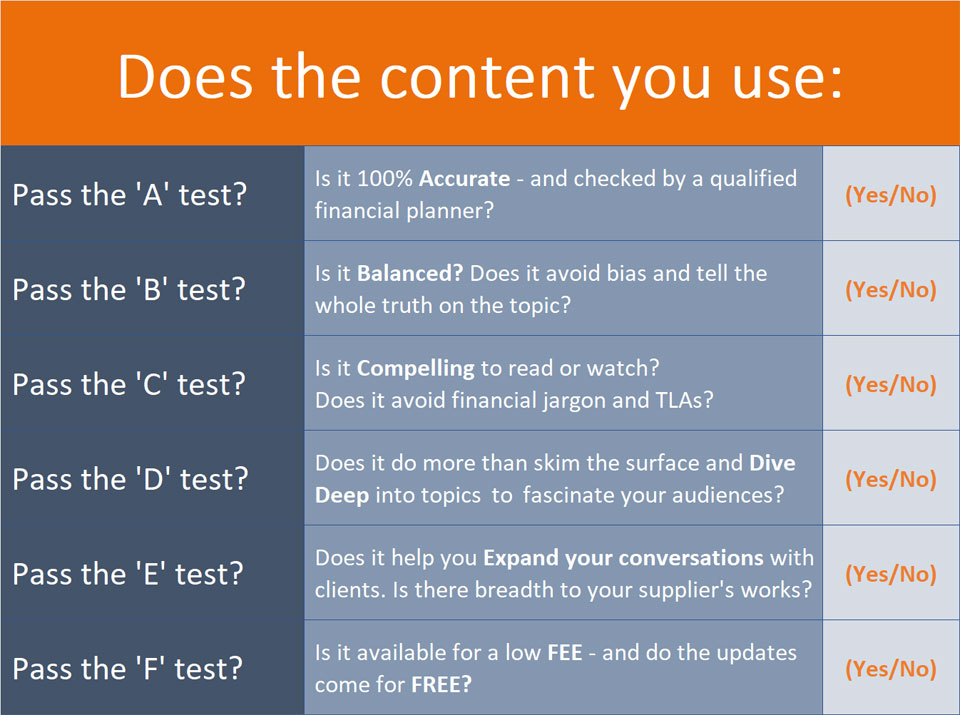

How do you check the quality of the content you use?

I know you only want to share top-quality content with your clients, prospects, and professional introducers.

That’s why I offer this guide with six (A to F) tests to help you choose a great content creator or supplier.

For now, here’s how I see the first three of those tests:

My Financial Planner friends tell me they love these ABC tests.

They’re certainly easy to remember, but they’re extremely hard tests to pass.

It takes enormous effort to create consumer-facing content that’s completely Accurate, Balanced, and Compelling.

However, this is the quality YOU need, so:

- Every Insight I supply is reviewed by at least two leading financial planners – one of whom used to mark exams for the Institute of Financial Planning.

- My Money Mindset pieces are checked by an acclaimed Doctor of Psychology with 20 years of clinical experience.

- All my content is reviewed by a communications specialist, who takes a non-expert consumer perspective. (A hard task master who ensures every sentence is clear and jargon-free!)

Is all this effort worth it?

You must decide after reading some of my Insights or testimonials here.

What else can I help you with?

Want a list of all 25 benefits of education-first marketing to all these people? Click here.

Want to know how much time and money you can save on content with a good supplier? Click here.

Need a process to rate the services of any content creator or supplier? Click here.

Could I help you help your clients?

Yes, if you want Insights to transform people’s lives.

Yes, if you want to engage potential clients by helping them:

- See the value of financial planning – and share those ideas with family and friends.

- Learn how to approach the big money

monsterschallenges in their lives. - Explore the Psychological traps around managing their money.

Research into financial literacy and anxiety about money shows that most adults (in most countries) need this kind of help.

So, I take care to design Insights that help consumers to:

- Feel more control around money questions.

- Understand and engage in the financial planning process.

- Know when they might need help from a professional.

Why do our money skills matter?

Perhaps you’re unaware, but we’ve known why educational marketing works since the 1970s.

It was the acclaimed Psychologist Albert Bandura who showed that people engage more in activities where they feel some confidence in their ability.

We don’t accept invitations to play competitive Golf (or tennis) if we’ve never held a Golf racquet 😉

The same applies to personal finance.

Most people don’t have a clue how to start a financial plan, so they don’t engage in the process.

And this is one of ten reasons most people don’t talk about money – as I’ve outlined here.

Bandura and other Psychologists found that when we don’t feel skilled enough, we focus more on our failings.

If we lack confidence, we tend to avoid complex tasks.

On the other hand, as we become more capable, we:

- Develop more interest in those activities and commit more strongly to them.

- Recover quickly from setbacks, and re-frame our problems as tasks to be mastered.

So, I design Insights that reduce the need for people to find that elusive thing called motivation.

This idea is beautifully illustrated here by the Social Scientist and author of ‘Tiny Habits’, Dr B.J. Fogg.

How’s your marketing motivation?

Do you need to engage more people in financial planning?

I guess the answer depends on whether you have all the client work you want today and how your pipeline looks.

Of course, the world never stands still. And the advice/guidance landscape is about to change significantly for the first time in decades, with new lower-cost services arriving from the FCA’s Advice Guidance Boundary Review.

‘Targeted Support’ will present both threats and opportunities to various advisory firms, depending on the complexity of the advice services they offer.

Of course, we can’t be sure how consumers will react, but initially, there can only be NEW flows of consumers into these NEW services.

Medium term, there’ll be two-way flows across all three boundaries in that picture, and continued circular flows of clients between advisers.

Remember, there are opportunities for you to explain the limitations of targeted support to your clients and prospects—and I have a growing library of Insights to help you with that.

Alternatively, you might choose to add a targeted support service alongside your full advice option?

All we know is that it’s risky to ignore this significant regulatory change.

And the winners, as always, will be those with strong propositions and compelling communications.

Are you concerned about the ‘advice’ and ‘awareness’ gaps?

The PFS National conference on 13 November 2025 is all about these topics. So there’ll be plenty of talk about this between professionals working in financial services.

But who’s talking to consumers?

How effective has our sector been at selling financial planning?

After all, Targeted Support is being launched to solve a decades-old, and sadly growing, advice gap.

Of course, we all know the reasons for this gap – which include the burdens of (excessive?) regulations and the time it takes to study and advise on nonsensical and ever-changing tax rules!

Whatever your view, we know the result.

About 92% of the adult population either cannot access (or don’t want/search for) regulated advice.

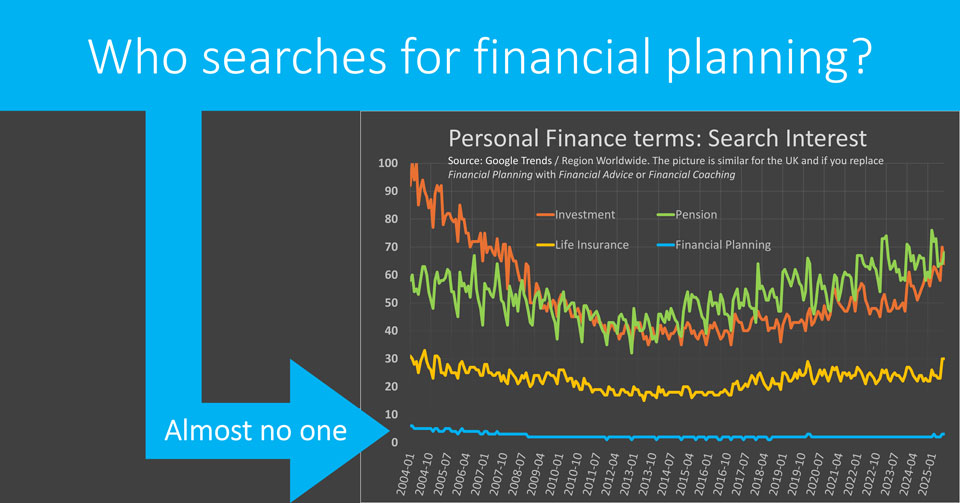

Here’s the evidence on the second point.

What does the chart show?

The hard truth is that while most financial planners and advisers do great work every day, the sector has failed to engage consumers in the value of it’s services – for more than 20 years.

Financial planning is *the* most valuable of all financial services.

But almost no one knows what it is – or searches for it.

FYI: The blue line on that chart also sits at the bottom if you change the search term to ‘Financial Advice’ or ‘Financial Coaching’ or, if you restrict the data to the UK.

More worryingly, research (from Schroders UK and Cerulli US) shows that up to 70% of inheritors (adult children and spouses) to wealthy advised clients plan to leave the adviser when the wealth holder dies!

So, we have enormous awareness and trust issues to solve here:

- Most people don’t know that financial planning is a service!

- More than 90% of UK adults don’t take advice from a qualified adviser.

- Around 60% of the families of advised people are unhappy with their parents’ / spouse’s adviser.

What educational gaps do you want to fill?

By offering brilliant (ABC) Insights, you showcase your helpfulness (and kindness) to your clients and their families and friends – and other prospects.

So, more of those people will contact YOU when they need guidance.

That’s why all of my consumer-facing Insights are designed to help you open people’s eyes to the value of YOUR services.

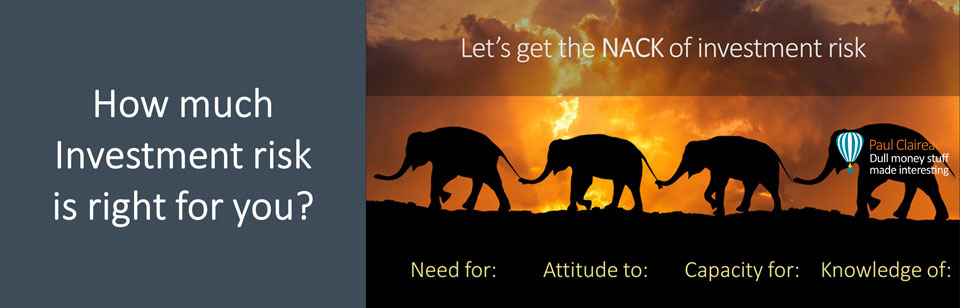

Here’s an example – on the classic consumer question of:

Various Chartered Financial planners tell me this answers that question perfectly.

Is your content supplier good enough for YOU?

If you plan to use (or continue using) a content service, you must decide if that service is good enough for your business.

And this Insight on six ways to test a content creator will help you do that.

For now, those tests are summarised here.

And at a sector level, the question is this:

How much of the content issued by all financial service firms do you (and your clients) believe passes the first four of those tests?

Most people I ask give a low percentage answer to that question, and the estimate is lowest among those who’ve worked in financial services!

What do you think?

Could we work together to change this?

More short posts are not the answer!

Sharing average / rushed daily short posts does not build engagement.

The evidence, as shown in my guide on ‘How to rate a content creator’, is that high-quality, long-form content is far more effective.

Read that when you have time; the facts surprise most advisers.

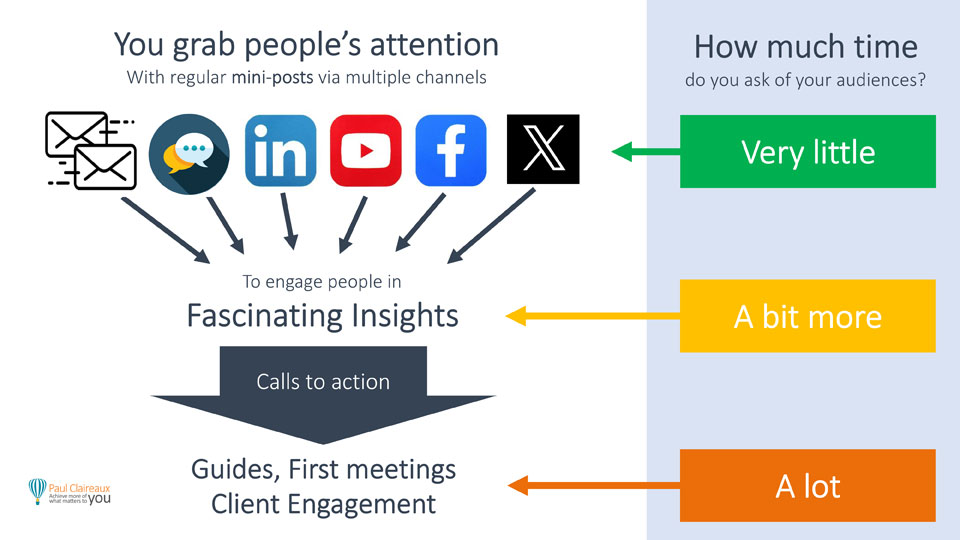

Of course, we need both short and long form content for effective education-first marketing.

Yes we do need plenty of short outreach posts for two reasons:

First, short posts are perfect for grabbing attention from prospective clients – who won’t give us much time until they know and trust us!

Second, we can use short posts to flag new or refreshed ideas to those people who do know (and hopefully love!) our work.

However, we cannot only offer short ‘attention grabber’ posts.

That’s like inviting people on a road to nowhere.

So, your short posts must attract and persuade some of your readers to stay with you.

To click through and follow the path you offer – to more complete Insights on your website.

That’s where they’ll gain more value from the ideas you share.

That’s where they’ll learn more about you, see your other works, and your testimonials.

So, that’s where they’ll become more likely to request your advice.

It’s not rocket science, and it’s not a new concept.

Here’s the idea in a picture.

If you offer deep dive content, you show your commitment to helping people make progress on their financial life journey:

Yes, it’s true that some people (some of the time) browse social media channels for entertainment and/or to see what their fellow professionals are discussing.

But few few of those people are potential clients or introducers of clients.

In marketing terms, they have no buying intent.

I assume you want to attract readers (or video consumers) who are actively considering a financial planning challenge.

You may also want to raise your profile with professionals, such as accountants or Solicitors, who are considering the financial challenges faced by their clients.

Either way, both groups of people will assign more value to long-form (high quality) Insights because those works offer complete solution ideas.

Can content creators save you money and stress?

Yes, absolutely, but only if they’re capable of creating content that passes those A to F tests.

If not, they’ll give you a big marketing headache, esp. if they’re poor writers or don’t fully understand financial planning concepts – which many copywriters do not.

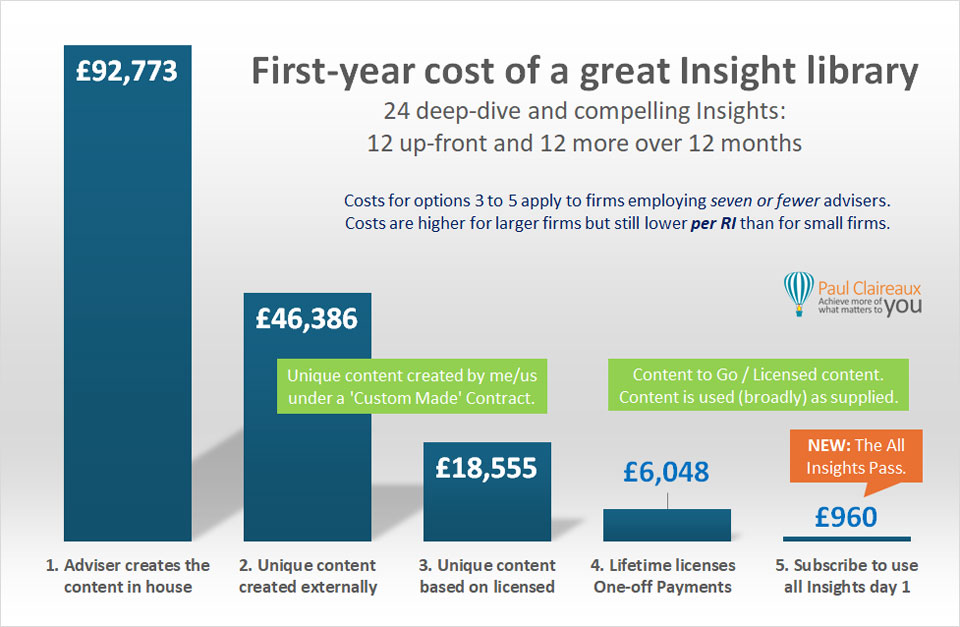

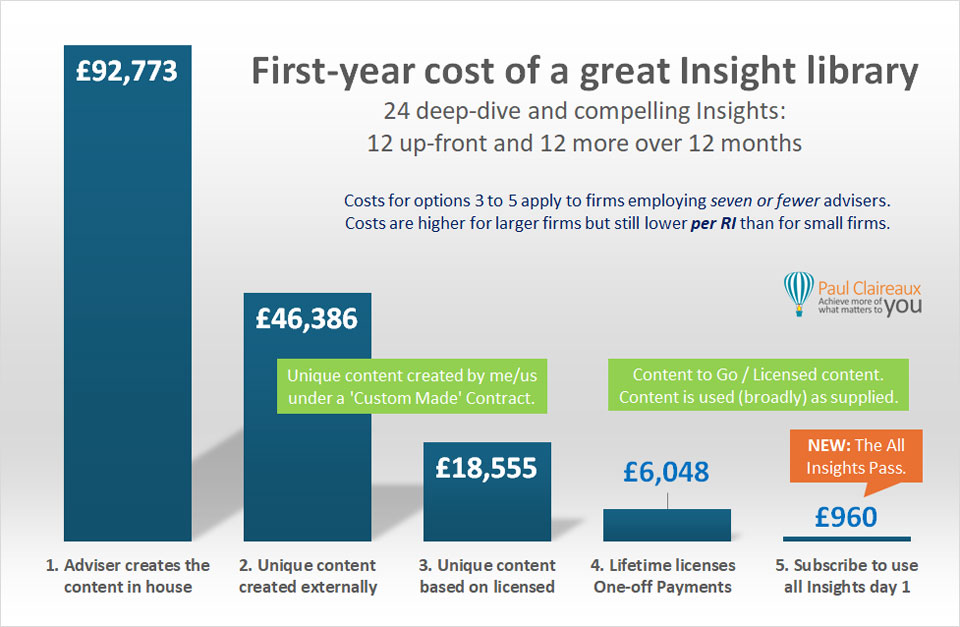

This chart illustrates the range of costs you face to build, buy or rent a great content library.

The chart illustrates how, by working with professionals, you can save between 50% and 90% (or more) compared to the cost of creating your content in-house.

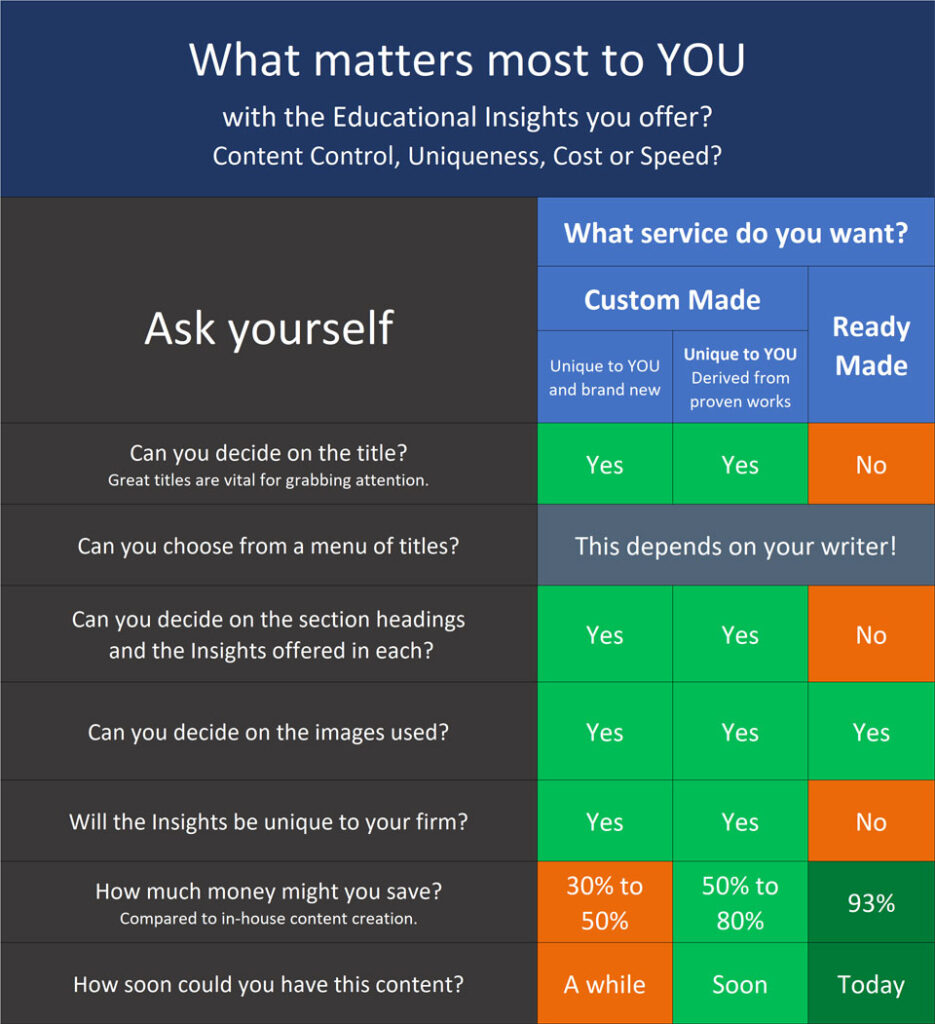

So, you must decide what matters most to you.

Is it the uniqueness of the content you use… or what it costs or how fast you can share it?

Or a mix of those things?

Either way, I can help you find top-quality educational content very keen prices.

And, if you’d like help in finding the right mix, book directly into my diary here

For now, this table will help you consider your options.

Notes to this table:

The two custom-made options allow you to influence the content – if you want to.

You’re not obliged to get heavily involved. If we work together, you could leave me to handle most of the content creation, if you prefer.

Either way, the review-based process I follow means YOU retain complete control of the messages.

So, YOU can be sure they’re 100% aligned with the way you do business.

Just be aware that with my standard licensed content options, the updates and upgrades are supplied for free!

So, you may want to consider using some licensed content for part of your educational library.

And you can access some great consumer-facing and evergreen Money Insights today, and use those for the life of your business!

What Insights could you white-label today?

Click on any image below to read that Insight – or series of Insights:

More money mindset Insights – coming soon

More money mindset Insights – coming soon

Most people I speak to are fascinated by the Psychology of managing and investing money.

So, perhaps you’re also interested in the Insights I’m writing now in this area – and the fact that they’re being checked by a Doctor of Psychology with 20 years of clinical experience.

The first title, ‘How many ways are you unique?’ is available now.

And I plan to offer these further titles for this NEW Money Mindset series over the next year:

- How do we form our attitudes to money – and how can we change attitudes that don’t serve us well?

- How can we boost our happiness – and how can financial planning help?

- Why do most people worry about money – and what can we do to worry less?

- How could you achieve more of what you care most about?

- Why do we get stuck on our goals – and how can we get unstuck?

- What are behavioural biases – and how might they hinder (and help!) our money decisions?

Want to influence the consumer Insights I create?

If you’d like to explore (and influence) the Insights I develop, let’s talk.

You can book directly into my diary here

I’d love to learn more about your business and help you engage more people in financial planning.

Whether you choose my custom-made or ready-made services, you’ll get educational Insights that are proven to help firms attract and engage more clients.

My aim is simple: to help you build (or maintain) your reputation as a go-to place for consumers to find answers to their vital money questions.

What could this mean for your business?

That depends on your current reputation as a Money Insight provider for consumers.

All I know is that I have helped firms to significantly boost their reputations, cut their content marketing costs, or do both.

I help firms move from wherever they are today to Zones 5 or 6 on this map.

Heard about my NEW All Insights Pass?

As the name suggests, the All Insights Pass provides immediate digital access and the right to use all my consumer-facing Insights for one low monthly payment.

It’s essentially a rental agreement to use my current and future library in your business.

While you pay the monthly subscription, you can use all of my licensable content. And all content updates and upgrades are included in the price.

So, if you’re happy to use licensed works for some of your content, this NEW Pass is the best way to start using my growing library of Insights.

You can find details of the All Insights Pass here

And, for a limited time, you can secure a fixed price subscription to this All Insights Pass for just £80 per month.

I expect the price for future new subscribers to rise by 50% or more, as the library doubles in size.

However, the price you secure when you subscribe will:

- Never go up in real (inflation-adjusted) terms.

- Not rise by a penny before January 2031.

So, if this ‘All Insights Pass’ is right for you, subscribe today at the launch price.

The price will be much higher for new subscribers in the future.

You can find more details of my All Insights Pass here.

Unsure which content service is best for you?

If you’d like help to establish your firm (or maintain your position as) a ‘go-to place’ for answers to vital financial questions, let’s talk.

These are realistic estimates of the range of costs to start (or add to) your library over a few years.

I’m happy to explain the assumptions used in this chart. They’re based on my extensive writing experience and VouchedFor’s estimate of average earnings per hour of chargeable time worked by financial advisers.

If you charge more or less than those scales, adjust the cost estimates in bar 1.

Either way, I’d be delighted to help you explore all your options on a video call.

I don’t mind whether you work with me or another content creator/supplier.

My only aim is to help you (as I help all my clients) to help consumers make better money decisions, and achieve more of their goals, for themselves and their loved ones.

You can e-mail me at hello@paulclaireaux.com, direct message me on LinkedIn, or book a meeting directly into my diary here.

Thanks for dropping in.