Don’t worry be happy

Is not the investment advice you need right now

“Don’t worry be happy” is a cheery little song.

But for goodness sake, let’s not confuse it – as some ‘market fanatic’ investment promoters do – with being great investment advice.

That, it is not.

At times like this – after long ‘bull’ runs have taken stock markets up to ‘frothy’ levels – you will see a lot of articles and broker notes saying, ‘don’t worry’ about your investments.

Now, come on, be honest with me… do you really think that’s great advice?

Or might that just possibly be a message used by fund promoters (and some advisers) to try and protect their (funds under management based) income?

Whilst you think about that – let’s enjoy the song 🙂

Just this week I attended a supposedly serious presentation by a world leading investment house.

And around 200 financial advisers attended too.

But sadly, the enthusiastic young presenter played down any BIG risks in markets right now… and, as is always the case, concluded that NOW was a really good time to be invested in equities (shares)

At another presentation (last year) from another leading investment house… we were told that, relative to the past 25-year average, market valuations were perfectly reasonable!

The only trouble with that argument is that it is very unreasonable – because the past 25 years is a ruddy ridiculous period over which to take your average.

You need to go back a lot further in history to get a real perspective on ‘value’ … and when you do that, you see that the current picture is not a good one.

And others have sounded the alarm bells too

Another investment bank observed last year that both bonds (fixed income securities) and Equities (shares) had been driven up to horribly expensive levels.

Indeed, in 120 years of history – these asset classes have never been so expensive at the same time.

So, is this ‘don’t worry’ advice – the dumbest you can get?

Well, it might be and here’s why.

It is true, as we’re reminded in this interesting article by Tony Isola, that, ‘there’s a huge bubble in unnecessary worry’ … and he’s right to say that one of our greatest risks is choosing the wrong thing to worry about’ 🙂

He also says that, ‘probability blindness is our enemy and that we vastly overstate the potential for cataclysmic markets events’

But this is not right when it comes to many professional investors who grossly understate the potential for big market events. More on that in a moment.

That said, we do tend to get a very twisted view of risks generally.

And there’s more evidence of this in this Business Insider article … where they pick up on Donald Trump’s worries about the threat of death posed by refugee terrorists.

According to this data – the typical American is:

- 6 times more likely to die from a shark attack (one of the rarest forms of death on Earth)

- 29 times more likely to die from a regional asteroid strike!

- 260 times more likely to be struck and killed by lightning

- 4,700 times more likely to die in an aeroplane or spaceship accident

- 129,000 times more likely to die in a gun assault

- 407,000 times more likely to die in a motor vehicle incident

- 6.9 million times more likely to die from cancer or heart disease

So, just sitting around and eating and drinking too much is the much bigger risk to all of us.

And that’s especially true for writers like me. So, after posting this insight I’m off out for my daily 3.5-mile hike 😊

Okay, but what about your investments?

Well, just because it’s pointless to worry about the risks of death listed above, does not mean you can always relax about risks to your money.

Sadly, the ‘don’t worry be happy’ idea – doesn’t always work.

So, the risks in stock markets (unlike the risks of being killed by an asteroid strike) do vary a lot over time.

The facts are that sometimes stockmarkets are very risky. Crashes do happen and they happen a lot more often than some of those experts will tell you.

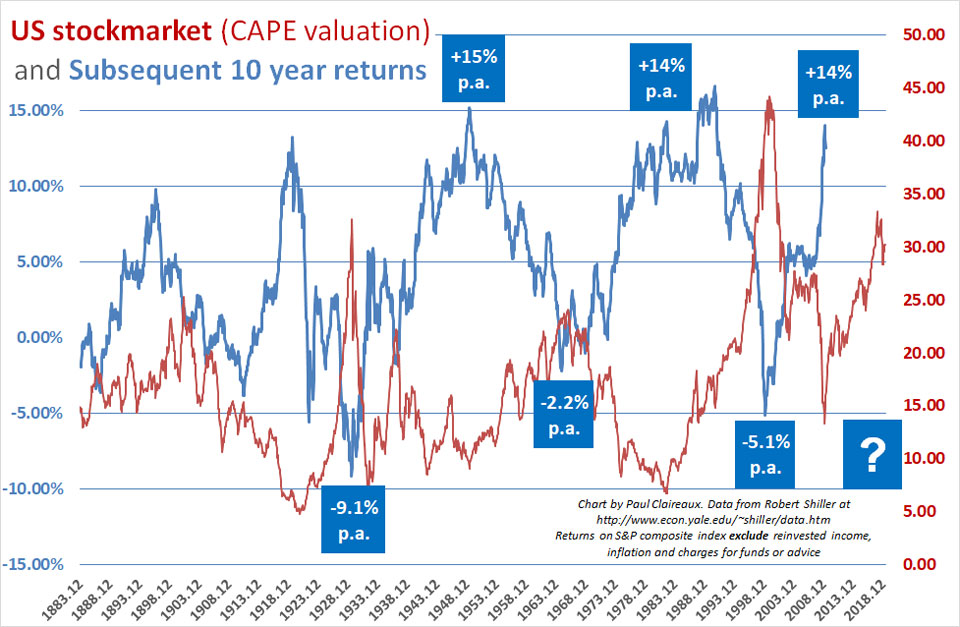

What is more, the big crashes, not surprisingly, tend to come after markets have been pumped up to silly valuations.

And they’re certainly pumped up now – on all this super cheap money we’ve had from the central banks since the crisis of 2008-09.

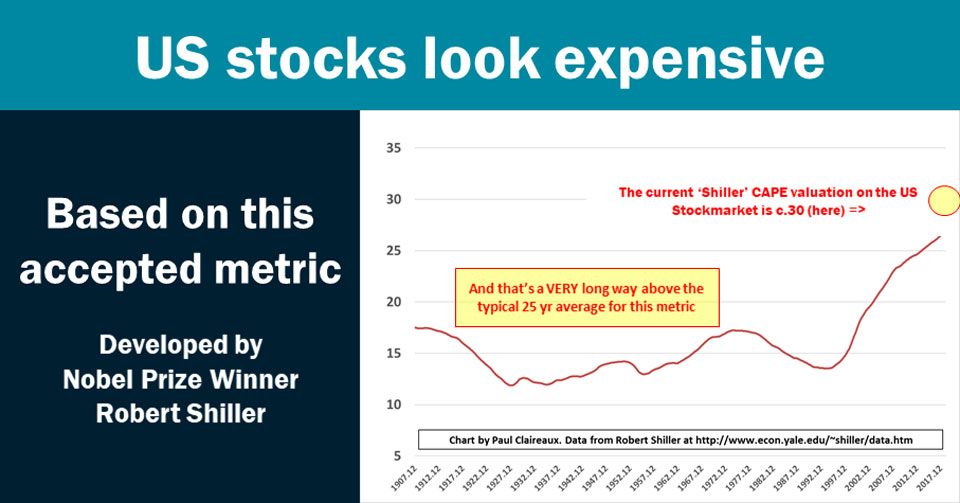

Looking at again at Shiller’s classic CAPE valuation metric, you can see that the US Stockmarket has rarely been up at these levels before.

In fact, on the only two previous times that it’s been up at these levels (1929 and 1999) a big crash in prices followed.

And it’s taken 400-year-low interest rates to pump it back up to where it is today.

This excellent chart and many others can be found at Multipl here

You can learn more about this clever Shiller CAPE metric here.

Now the Nobel Prize-winning economist, Robert Shiller (who developed that metric) doesn’t think there’s much prospect for any real returns on the US stock market over the next 10 years or so.

His best guess (and they can only be guesses, whoever you talk to) when last pressed for an estimate in May 2017… was for real (above inflation) returns of just 1% p.a. on that market over the next decade.

That equates to a return of ‘zero’ or less, in real terms, after fund and product and adviser charges have been stripped out.

So, it can really help to see stock markets in this perspective… and see how they might be getting ‘ahead of themselves’ at times like now and 2007 and 1999 and 1965 and 1929.

Of course, it’s not just investors in US stocks who can get over excited either.

In 1989 – the only game in town was the Japanese stock-market

So, as this chart from MacroTrends shows nicely… Japan enjoyed an incredible boom in share prices in the 1980s.

And, at that time, nearly 80% of ‘expert’ institutional investors thought that the Japanese Stockmarket offered fair (or even good) value !!!

What happened as that bubble burst were price falls (and some false dawns) that lasted nearly 25 years

So, am I predicting a crash on the US or UK stock markets?

Well, I’m not saying there won’t be one – but I’m not saying there will either.

Sorry but no one can predict these things.

However, I am saying that the US Stockmarket looks particularly ‘vulnerable’ to getting upset right now.

And that’s because it’s sitting at such a high level – relative to its long term history… plus the fact that interest rates have begun to rise -after being held down so many years.

Here’s more on the asset price bubbles being blown by low interest rates

So, are you the lucky one – swimming naked?

Sorry but I just love to get my favourite music into these posts and ‘The lucky one’ just seemed to fit there.

We’ll come back to swimming naked in a moment.

Of course, you may not need to worry about your investments if you have a brilliant financial planner and some super brilliant fund managers behind them.

In that case, you really are the ‘lucky one’ but very few are in that fortunate position.

And quite a few of those who think they are – might be surprised to learn that they’re not.

They just don’t know it yet because markets have been rising beautifully for several years now.

And we humans have evolved (for reasons of self-preservation I guess) to have short memories of bad events.

So, after a crash, we very soon forget what market risk looks like.

Or, rather I should say, those who were not caught badly in the middle of the last crash – tend to forget it.

As Tim Harford wrote recently in the Financial Times,

There are many historical examples of manias and panics but, while most of us know something about the great crash of 1929 or the tulip mania of 1637, those events have no emotional heft.

Even the dot-com bubble of 1999-2001, which should at least have reminded everyone that financial markets do not always give sensible price signals, failed to make much impact on how regulators and market participants behaved.

Six years was long enough for the lesson to lose its sting.

But what if you’re heavily and happily invested right now?

Well, of course, most investors are happy whilst markets are rising strongly.

And other than reviewing your ‘capacity for risk’ – more on that below – the best thought I can offer you is this… from the man who many regard as the greatest investor of all time:

So, if you’re happy to stick with this Insight a while longer …

Let’s explore how you might be misled about Stock-markets

And this applies equally to any risk-based investment – including buy to let property.

First, you might be told that the risks of market crashes can be ignored.

Solution – ignore that advice. The risks are real and need to be factored into your planning.

Second, you will come across data that’s been twisted and spun to ‘frighten’ you into staying heavily invested.

And third, you will read a lot of ‘so-called’ advice – that takes no account of your personal situation.

Let’s look at each of these issues – in a little more depth – in turn

Ignoring the risk of market crashes

Can I tell you what risk there is – of a stock market crash at any given time?

No, of course not – and nor can anyone else.

That said, it’s quite clear from this chart alone, that the risk of seeing market prices fall, for an extended time, are much higher at some (red peak) times than others.

And whatever the risk of a really nasty reversal in prices, it’s really quite clear that

The level of that risk is not constant

So, please don’t listen to anyone who tells you it is.

Markets reflect economies and economies reflect human activity – which is highly fluid and unpredictable.

Sadly, there are quite a few people in the financial industry who think they can tell you the probability of a big crash… including some seriously heavyweight financiers – in the past at least. More on that in a moment.

And, sadly, too many financial advisers believe they can tell you the levels of these risks too.

But most properly educated investors stopped believing in that after the financial crisis of 2008-09.

The story about the Investment banker

Now, are you up for some ‘dark’ humour?

Because there’s a ludicrously funny (and true) story that might help you remember this concept.

It involves a guy called David Viniar, who was the Chief Financial Officer of Goldman Sachs during the crisis.

Viniar famously commented that the scale of the crash (in 2008-09) was completely unpredictable to any banker … claiming that 25-standard deviation price moves had occurred on several successive days.

Now, don’t worry, I’m not going to bore you with a load of Maths here.

This is a plain English website remember 😉

Suffice to say, if you hear people talking about ‘standard deviations’ around investment risk – you might want to start worrying.

Why?

Well, because it could mean that the person you’re talking to believes in a model of risk that simply doesn’t work 🙁

Here’s more from a quiet mathematician – sadly no longer with us.

The KEY point to understand is that standard deviations are nice neat statistical terms.

And they can certainly help us understand some types of statistics – which have a meaningful ‘average’ number.

They fit nicely, for example, if you’re dealing with the distribution of peoples heights or weights.

The trouble is that they do not fit the data on stock markets… because stock market prices don’t have any meaningful average return.

So, you CANNOT use them to predict the risk of crashes in markets – whatever anybody tells you!

But don’t take my word for this – here’s that funny story from the serious experts.

Just how unlikely is that?

In 2008, just to hammer home the point that these old risk models don’t work, a group of academics (Kevin Dowd, John Cotter, Chris Humphrey and Margaret Woods) from Nottingham University Business School (Centre for risk and insurance studies) produced a serious but very funny paper.

In 2008, just to hammer home the point that these old risk models don’t work, a group of academics (Kevin Dowd, John Cotter, Chris Humphrey and Margaret Woods) from Nottingham University Business School (Centre for risk and insurance studies) produced a serious but very funny paper.

And in a nutshell, it exposed the fact that Mr Viniar – along with most other investment bankers – were using the wrong risk model !

Amusingly, they called their paper:

‘How unlucky is 25-Sigma?’

And their findings, on the unlikeliness of Mr Viniar’s description of events, is truly breath-taking.

Here’s how they describe the chances of ‘big events’ in this model.

This ‘normal distribution’ model claims to measure risk by ‘deviations’ from some theoretical average return.

(Sigma, by the way, is just shorthand for 1 standard deviation)

- A 5-sigma event is equal to an expected occurrence of less than just one day in the entire period since the end of the last Ice Age

- An 8-sigma event is equal to an expected occurrence of just once in a period, which is considerably longer than the time elapsed since Big Bang, and

- A 20-sigma event is equal to an expected occurrence of one day in a number of years equal to 10 times the likely number of particles in the universe.

So, quite clearly, these are impossibly small chances!

But wait… we’re not yet at Mr Viniar’s 25-sigma assessment of what happened in 2008.

And, according to the academics at Notts business school, we would need to take that 20-sigma event chance and divide it by 10 … not once but … 50 times in succession.

So, these sorts of chances are simply impossibly small to imagine.

And this is why (because they used a bad model of risk) that investment bankers used to think it was okay to ignore these big risks!

Simple eh?

Yes, very simple!

Now, bear in mind that this is just one single 25 sigma event.

Think how unlucky you’d need to be for a 25-sigma event to happen several days in a row!

This Nottingham Business School paper is a very funny piece of ridicule.

But it’s also quite sad, I think, that this wrongly held belief was allowed to inflict so much damage to the world economy?

You might be aware that our Queen asked the economics profession for an explanation of ‘Why no one saw it coming?’ after the financial crisis.

And, at the second time of asking – several years later – she got an explanation from the Bank of England – which, in even simpler language – described what I’ve outlined above.

Curious that it took so long though eh?

When Economists are challenged on their flawed theories, like a lot of people who are ‘wedded’ to ideas, they are likely to take a long time to back down and accept that they were wrong.

That’s human nature.

What can you conclude from this?

Well, surely it’s this.

That the world’s most hideously highly paid bankers

had absolutely no idea what risks they were taking

with our money and the world economy

before the global financial crisis.

And that’s a very scary thought.

But here’s an even scarier thought

What if your investment adviser still uses that broken model of risk to advise you on the risks in your portfolio?

So, please listen up.

If your adviser tells you that Stockmarket crashes are ‘outliers’ or that such things only happen ‘once in a generation’…

or they talk to you about ‘Standard deviations’…

you need to start asking some difficult questions and fast – because they’re probably using the same risk model as Mr Viniar!

And I assume that you do NOT want to be on the wrong side of that model when it goes wrong again, which it will – that’s one thing we know for sure.

Now, if you’d like some ideas on how to test your investment adviser take a look here.

Let’s twist and spin, like we did last bubble

The second type of misleading message on investments is the one which twists and spins some data to persuade you to stay fully invested once you’re already in the markets.

This old chestnut of a misleading story has been trotted out more times than you and I have had hot dinners.

It’s aimed squarely at existing investors – whether you’re invested directly into a portfolio of shares OR via some kind of ‘financial product’ (like a collective investment fund or a Stocks and Shares ISA, or Pension or Investment Bond etc)

And it’s the story about how ‘coming out’ of the markets (even for a while) can be seriously bad for your wealth.

Once you’re in, so the story goes, you need to stay in because if you come out, you risk missing the best days’ – when the markets make their biggest gains.

And, so the story goes, you really don’t want to do that – because it will wipe out any chance you might have had of making good returns on your money over the long term’

Heard that one before?

Yes, me too – and here’s the thing. It’s complete and utter hogwash.

And extremely dangerous hogwash at that.

So, if you’ve not already done so… please read this article to understand why this story is so misleading

Then, you’ll be equipped to make better decisions about your money.

And you’ll know that you do not need to stay heavily invested at all times.

Whatever you do, please do NOT get taken in by this ‘missing the best days’ story.

It’s grossly misleading and sadly, a number of leading fund houses …

… and a lot of financial advisers are still using it.

Know your ‘capacity for risk’ – on each of your life goals

If you’ve been reading my work for a while, you’ll know that this is one of my favourite topics.

The thing is, your personal financial plan needs to be… well… personal to you 😊

So, when it comes to deciding on how much of your money to hold in the ‘markets’ at any given time… one of the key ‘personal’ factors that you need to consider is your capacity for risk on each of your personal financial life goals.

For example, how might you invest a lump sum that you’re going to need for a trip around the world in 3 years’ time?

Cautiously might be the answer!

Indeed, if you don’t have a lot of other spare capital – you might want to keep this money locked up safe in some kind of bank or building society account.

On the other hand, what if, perhaps at the same time, you’re saving regularly into a stocks and shares ISA to build a fund to support a child through university – 16 years from now?

How would you invest those regular savings?

Clearly, you have the capacity to take more risk on those savings than on your lump sum investment.

So, just remember that:

- Your ‘capacity for investment risk’ (CFR) can be higher than your general ‘attitude to risk (ATR) when you save regularly over the long term.

- But it might be lower when you invest a lump sum over a shorter term OR when you’re using an investment or pension fund to provide you with an income.

Your capacity for risk is also affected by your overall wealth position – and whether or not you could withstand a big drawdown in market prices.

So, the super wealthy don’t need to worry quite as much – if their investments crash in value – they can just sell one of their properties or a Yacht 🙂

They really are the lucky ones when it comes to not needing to worry about risk.

Learn more about why your ‘uniqueness’ matters to your financial life planning here

And here’s the thing

We all have different goals in our lives.

We all have different levels of ‘disposable’ income to save and assets to invest.

We all have our own unique attitude to investment risk

And we all have our own, unique capacities for risk on each of our financial life goals.

So, whatever you read, just ignore any simple rules or advice on how YOU should save or invest your money.

There are no rules of thumb.

The answers are different for everyone and should relate to your longer-term goals for yourself and your loved ones.

Conclusion

Look, I don’t want you to worry unnecessarily about your investments.

But I do want you to take an interest in them and to be aware of the very real risks that exist in asset markets (both shares and property) at the current time.

You have a choice here.

You can do nothing and that might be the right answer for some people – like the super wealthy who have a very BIG capacity for risk.

But for the rest of us mere mortals 🙂 – we need to review our investment risk exposure from time to time.

And we need to make sure that it reflects both our attitude to risk AND our capacity for risk on our various financial life goals.

And, if you’ve not done a complete job on this recently, then right now is a good a time to do it.

It’s just one of many things I teach my clients how to do.

Hope that helps

Take good care out there

And thanks for dropping in …

Paul

For more ideas around money and personal performance, in an occasional newsletter, sign up here.

And, as a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ … and the first chapter of my book, ‘Who misleads you about money?’

Or, if you’d like more frequent ideas (and more interaction) …

And feel free to share your thoughts in the comments below.

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article