About Paul Claireaux

Hello, what’s brought you to this page?

Do you want more background on me – to know whether you can trust the money Insights posted on this site?

Or, are you a financial adviser, planner, or coach thinking of using some of my work in your business- to help inform and engage more clients?

Either way, you’re in the right place – to check my credentials and experience.

Also, if you’re a financial professional and want to know if we share a vision for the future of personal finance, visit my ‘About You and Me’ page when you’re done here.

This page is a 10 to 20-minute read, depending on your speed.

Ten helpful facts about me

Don’t fancy reading the whole page?

Don’t fancy reading the whole page?

Fine, here are ten things you need to know about me.

- You’ve probably not heard of me, but my educational content now reaches around 5 million people across the UK via my blue-chip financial service firm clients.

- I’m a family guy – and have three adult sons. Harry is an Orthopaedic Surgeon, George is a Data Engineer, and Edward, a materials scientist. These guys are my ‘WHY’ for my work.

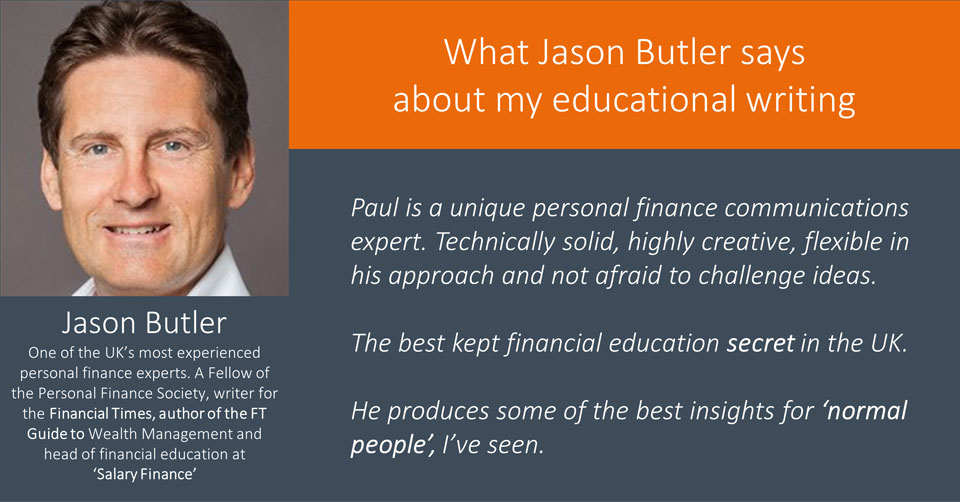

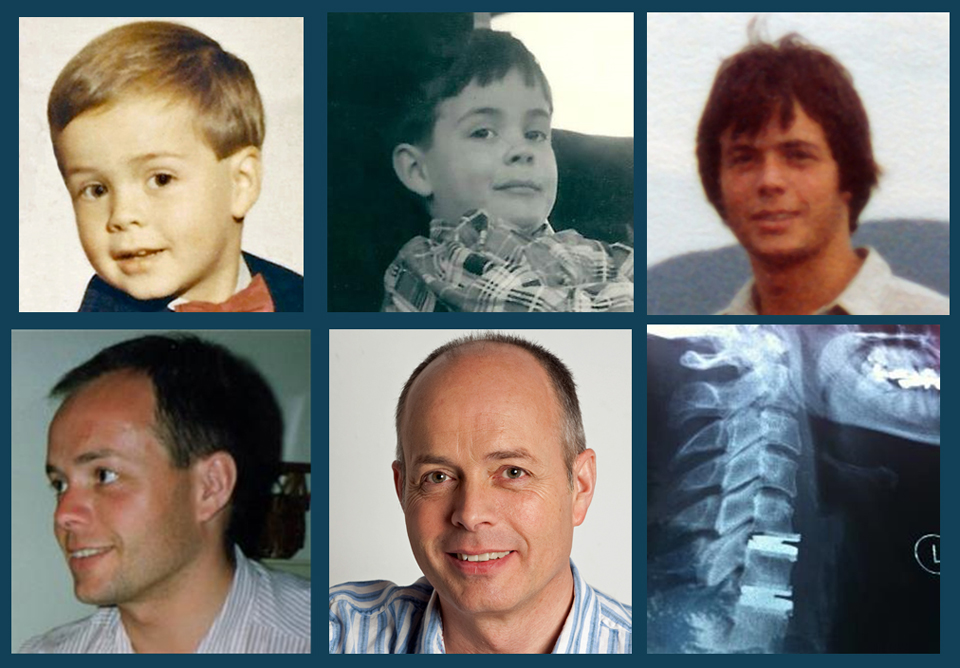

- I started writing my first book, ‘Who Can You Trust about Money?’ in 2011 to leave a legacy to these lads after two operations on my spine (to replace discs in my neck), which reminded me of my mortality!

- I published that acclaimed 400-page, two-part book at the end of 2013, and plan to write another book next year.

- The last image in the matrix above shows two titanium joints in my neck where discs used to sit. I’ve also had operations to alleviate pain in my back. The good news is that I no longer have pains in the neck, at least not in the literal sense!

- My main passions, other than family, have included flying light aircraft and ski-ing – downhill – and this is relevant because there are many parallels between these activities and financial planning – which we can explore at another time.

- I studied Engineering at University, which means I’m careful with numbers, charts, and complex problems.

- I’m an escapee from the Investment and Pensions Industry, where I enjoyed two highly successful careers over 25 years. I spent eleven years working closely with hundreds of financial advisers – to solve financial planning challenges for their clients. Then, I spent 14 years in various marketing and product development roles, leading teams to design and develop investment and pension products.

- I’ve passed various advanced financial planning exams in taxation, investments, and pensions. I love to demystify money matters to help people make better decisions – because we all need help with that.

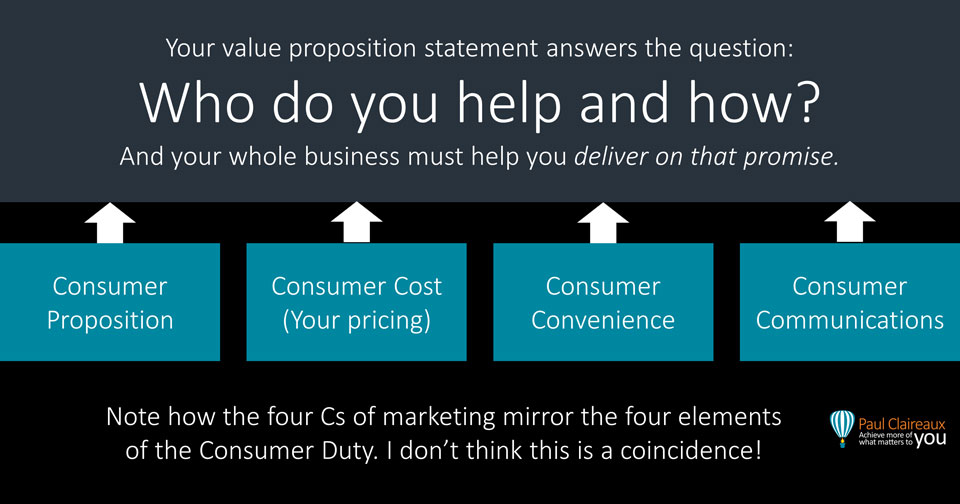

- Much of my work involves designing and developing educational programs that help good financial service firms (advisers and financial product/fund and service providers) become Go-To places for answers to key money questions.

I love my educational work and plan to keep creating this content for many years to come.

If you have the time and the interest in the challenges of content creation – this conversation with Lee Robertson might interest you.

Otherwise, if you just want to know about my content creation services – head to the base of this page.

Or read on if you’d like to learn more about:

- My personal life and interests.

- What others say about my works (books, guides, and video explainers)

- How I acquired a passion for financial planning.

- My two careers in financial services.

- My great escape from the corporate world.

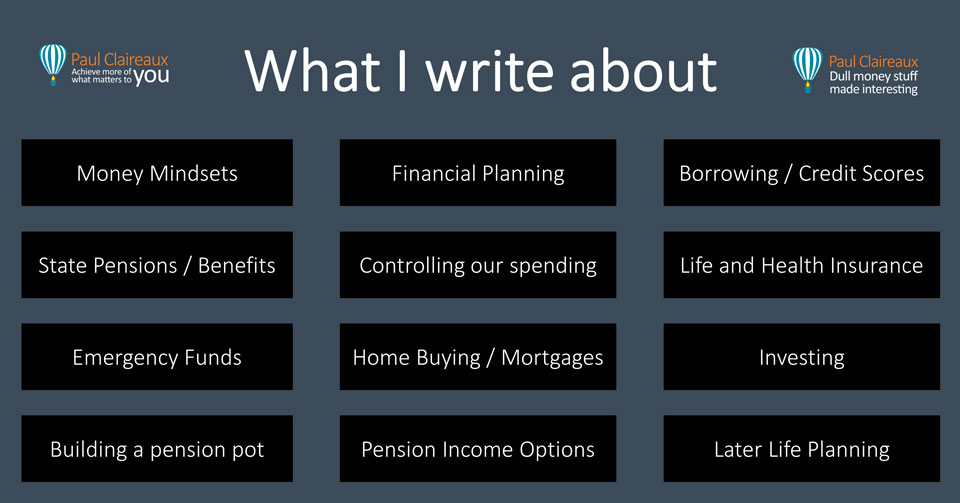

- The categories of educational content I write about.

- How could I help you?

My personal life – and interests?

I’m a proud father to three adult boys (a surgeon, a data engineer and a materials scientist) and became a grandfather last year.

I’m a proud father to three adult boys (a surgeon, a data engineer and a materials scientist) and became a grandfather last year.

I went through a challenging divorce about 23 years ago, which I think we’ve all survived.

I’ve been happily re-partnered with Wendy for 20 years now. And, along with their other parents, we’ve raised five children together.

So, it was very busy (and expensive) on the home front for a great many years.

My other interests have included playing the piano and flying light aircraft.

I held a private pilot’s license for 25 years, which I’d say taught me more about human psychology than anything else.

Life-threatening scenarios concentrate the mind!

I also love to ski – with family and friends – when I can.

What do others say about my works?

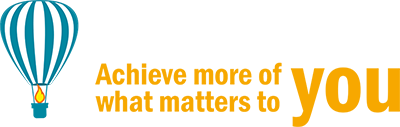

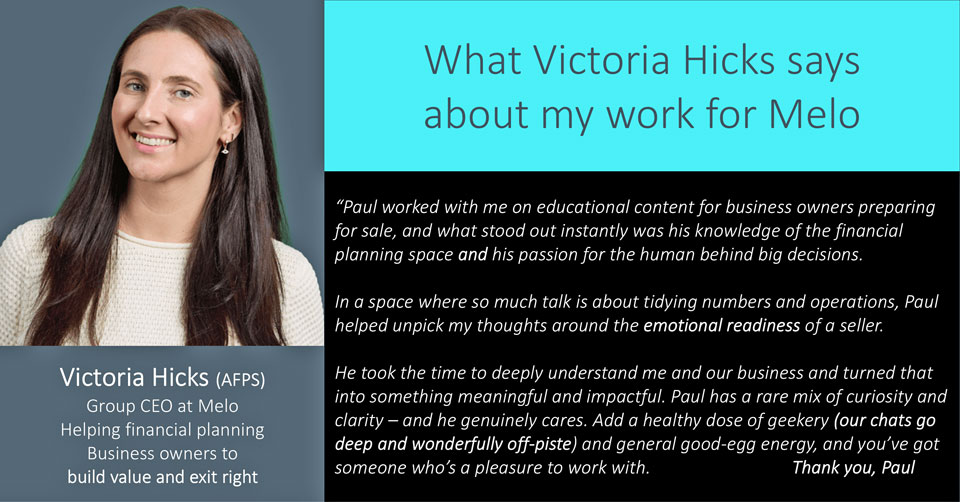

Here are a few testimonials.

There are more on the home page of this website – from those who’ve read my books or attended an educational workshop or coaching session.

How I acquired a passion for financial planning.

Like many from my generation, I landed in financial services by accident.

The cause was a fallout with my father, for whom I worked (in his Coach and Haulage business) in my early 20s.

I had to find other work!

This was a serious fallout, and I don’t mind sharing the details with you – if we explore working together and you’re interested.

Suffice it to say that my father and I barely spoke for about three years after that.

Thankfully, we eventually repaired our relationship – following, of all things, a conversation on financial planning matters!

In short, a couple of years after working for a leading pensions and investment house, my parents asked me for ‘advice’ on switching a reasonable sum of money between bank accounts to earn a little more interest.

I pointed out the risks of depositing monies with certain high-interest paying building societies (the financial compensation scheme only protected about £3,000 of your deposits back then!) and suggested they explore a straightforward idea—with their accountant—for saving tax with lump sum pension contributions.

It was extremely valuable guidance for self-employed people like my father (and mother) at that time, given that they had 50% tax relief available and could secure 17% p.a. annuity income payments.

They were both able to ‘immediately vest’ their pensions – and after about two years of switching on the annuity, they both enjoyed a guaranteed lifetime flow of income – effectively for FREE!

I’m happy to explain this if you’d like me to.

I’ll probably write an Insight on this using current rates at some point.

What astounded me at the time was learning that my parents’ accountant had failed to provide pension advice for decades.

Given that this advice helped to repair my relationship with my father, I’ve always remembered the value of sound financial planning.

My two careers in Financial Services

I’ve always enjoyed problem-solving and number-crunching, which I’m told helps me demystify complex financial concepts.

The challenge is to avoid simplifying things so much that your content becomes misleading.

I see a lot of writers (and those who post on social media) fall into this dangerous trap.

As Einstein said,

Everything should be as simple as it can be – but not simpler!

AND

Whoever is careless with the truth in small matters, cannot be trusted with important matters.

Our biggest challenge with financial education content is to make all that dull stuff interesting without it becoming misleading.

That’s why I developed this new version of my logo.

People are misled if they’re told that financial planning is common sense: it’s really not, as I outlined here.

People are misled if they’re told that financial planning is common sense: it’s really not, as I outlined here.

We need to be clear about this, or people will not bother hiring the expertise they need to make sound financial decisions.

I studied Electrical and Electronic Engineering at University for a while, and there were plenty of hard Mathematical problems to solve there.

These skills made it easier for me to learn the more complex aspects of personal finance, and I certainly enjoyed exploring various pension, tax saving, and investment planning ideas.

My first role in financial services was as a Broker Consultant with Clerical Medical – a respected top-5 provider of pension and investment products to the Independent Financial Adviser (IFA) market at the time).

This was long ago, and my business card read ‘Life Inspector’ – a title I can explain later. In short, the titles Life Inspector or Broker Consultant were conjured up because we British don’t like to use the word ‘Sales’ in a job title—for fear of attracting the wrong kind of people.

Of course, that’s what the job was: business-to-business selling to position Clerical Medical’s products and services to Independent Financial Advisers (IFAs).

After a few years of hard work, I became Clerical Medical’s top salesperson in the UK, out of a team of 200.

So, I guess I mastered the ‘art’ of business-to-business (B2B) selling —or ‘relationship’ selling, as I prefer to call it—because it is about building long-term relationships.

You’re hoping to establish a stream of sales. It’s not about landing just one.

What makes a good salesperson?

That’s a great question; the answer has various dimensions – and some would surprise you!

I want to help others master their sales skills, so I plan to launch a new workshop on that later this year.

I hear that financial planners don’t get enough sales training these days – is that right?

Either way, drop me a line if you’d be interested in having that workshop for your team.

Of course, learning some listening and conversational skills is essential so you can find out what really matters to your potential customers.

And you must be disciplined and conscientious enough to respond appropriately and in a timely fashion.

Back in the day, I was able to make good use of the expertise we had within Clerical Medical’s ‘Financial Planning’ technical unit – arguably the best in class at that time.

I also passed a series of Financial Adviser exams (including advanced papers in Tax and Trusts (G10) and Pensions (G60)), which enabled me to speak their language and help them solve clients’ financial challenges.

Changing Tracks – the move into product development

I soon learned that my sales role was just one element within communications of the marketing and sales division.

I soon learned that my sales role was just one element within communications of the marketing and sales division.

And that communications was only one element of the wider business system.

One of the benefits that came with success in sales was that the product development managers tend to listen to your feedback – and want your ideas.

So, alongside my day job, I made it my business (and engaged other leading Broker Consultants in the cause) to push our marketing people for product improvements and new products where we had gaps in our range.

For what it’s worth, I see this as a key part of all client-facing roles – to give constructive criticisms of the services offered so we don’t fall behind the leaders.

As a consequence of these efforts, after 11 years in Sales (including two as a National Accounts Manager dealing with senior managers of the UK’s leading IFA firms), I was invited to become one of four Product Development Managers at Clerical Medical’s Bristol Head Office.

In this fascinating role, I learned about marketing and managing multi-site projects employing hundreds of people.

I also led the product team that took our core investment products to number 1 and 2 (by sales volume) in the UK IFA market.

Overall, I enjoyed my sales and marketing careers.

The only downside to the head office promotion was that my earnings were half of those in my previous sales role (there were no big bonuses for head office jobs) while I had to undertake twice the workload to lead complex projects!

My growing concern about the sector.

However, one issue with the investment and pensions sector that was increasingly concerning me over this time – was the focus on making rich people richer.

This issue has gotten much worse in recent years—to the extent that less than one in ten people now receive financial advice.

This is not to say that everyone needs financial advice; they don’t, but more than one in ten people do.

Also, to be fair, this shortage of advisers (and adviser time for ordinary investors) is caused by various factors, including the complexity of our tax and pensions rules – and the burden of regulation.

So, I’m not blaming the advice sector for the problem – in many ways, the problem has been caused by Government and regulatory bodies.

But it just didn’t feel right to me, given that the high-value service of financial planning was reaching such a small minority of people – those with most liquid wealth.

That fact and the mess created by the Big Banks’ takeover of the pensions and investments sector led me to start tunnelling to escape my employer’s clutches at every restructure.

FYI, Clerical Medical was bought by Halifax, which merged with Bank of Scotland to become HBOS.

Happy to discuss the impact of that if it interests you!

The great escape to focus on educational work

My early applications to get on the ‘happy leavers’ bus were declined with the message that ‘we need your skills here’ – a bitter-sweet compliment meant more bank run misery ahead.

So, in one way, it was good fortune that my health had begun to fail because when I started having operations to repair failed joints in my back and neck (see here), my managers realised it might be in their interests to let me go.

It took a few years, but I eventually escaped the big corporate world in 2011 to spend a few years writing (two books) and spending more time with my young lads.

I also trained in and experimented doing Financial Coaching and Group Educational workshops. But eventually realised (as many do) that the direct to consumer market (for those services) is extremely difficult to make pay!

So, in 2018, following an invitation from Jason Butler (see above), I started a fourth career as a writer of consumer-facing educational content for other firms.

For good-quality (and purposeful) financial service firms.

And I guess I’m (a little bit!) proud to say that my educational content (in video and colourful guide formats) has reached more than 5 million people across the UK.

This content is delivered through my clients, such as Salary Finance, Money Alive, Fidelity, and some adviser firms, so the end consumer has no idea who wrote those money Insights.

That’s okay for now, as I have the testimonials above—and the big benefit for me is that I love writing educational content.

I get to study the best books from genuine subject matter experts, like those I’ve started to share on my books IRATE page.

And, I get to stand on the shoulders of those giants (and others) to develop Insights that help people make better decisions about money and life.

What’s not to like?

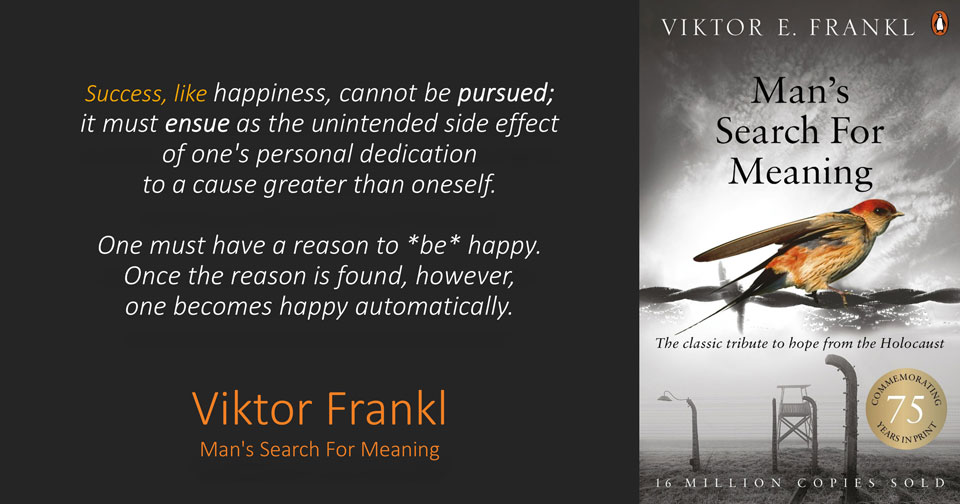

It turns out that genuinely purposeful work, as Frankl and others have observed, makes us happier too.

It turns out that genuinely purposeful work, as Frankl and others have observed, makes us happier too.

So, if you’re not yet embracing education-first marketing in your business – I urge you to do so – for your own wellbeing as well as that of others.

Writing (and sharing sound insights from others!) offers us enormous personal benefits – as these famous people can tell you.

Offering educational content offers enormous business benefits too – if you’re in the financial services or life coaching business. And I can send you a list of 25 such benefits if you like.

My clients tell me this list is extremely useful for creating a business plan for an educational programme

Just e-mail me at hello@paulclaireaux.com with the message ‘send me the 25 benefits’ and I’ll send you that pack.

What do I write about?

This last section is mostly for financial professionals, but it will give everyone a sense of the scope of my work.

In short, I’ve written hundreds of Insights on matters of money and personal performance – under these categories and more.

When we start work, I typically give my clients that list to help them consider the scope of their educational programme.

Visit my ‘About You and Me’ page for an idea of the scale of tasks required to develop a broad program of content.

From my recent experience, I’d say Insights into money mindset questions are a great place to start.

After all, many people avoid talking about money issues with anyone – and they’ll not seek advice, planning, or coaching unless that changes.

That’s why some of the early content I’m offering is to get people thinking about why they don’t talk about money!

I’ve also written a series of guides on the human side of money – for Fidelity Advisor Solutions.

These guides have been extremely well-received by Financial Planners across the UK, and if you’d like those guides rewritten or to have Insights on similar topics to post on your website – with your branding and unique calls to action – we can discuss creating those for you.

(You can’t white-label the Fidelity Guides, by the way)

How could I help you?

This is covered in detail on my ‘About You and Me’ page.

In short, I help financial service firms become go-to places for trustworthy and fascinating ideas about money – in a variety of ways. And all my new educational Insights point consumers to professionals for help where it makes sense to take guidance or advice.

I do more than create content for firms – but in terms of my content creation services I now offer two services:

- My Content-to-go service offers high-quality (lifetime) licensed educational content – for around 90% less than it costs firms to create their own.

- My Custom-made service is for those firms who want help creating unique educational content.

You can view the licensed content currently available in the Content Store here.

I plan to add a lot of new content to that store over the coming weeks and months.

So, sign up for my Educators Newsletter to be the first to see the new content.

You can also request examples of videos and written guides I’ve created by emailing me at hello@paulclaireaux.com

Or, if you’d prefer to explore your ideas in conversation, book a meeting directly into my diary here.

Thanks for dropping in and for your interest in my work.

Whether you’re a novice or an expert in personal money matters, I imagine we can agree on one thing.

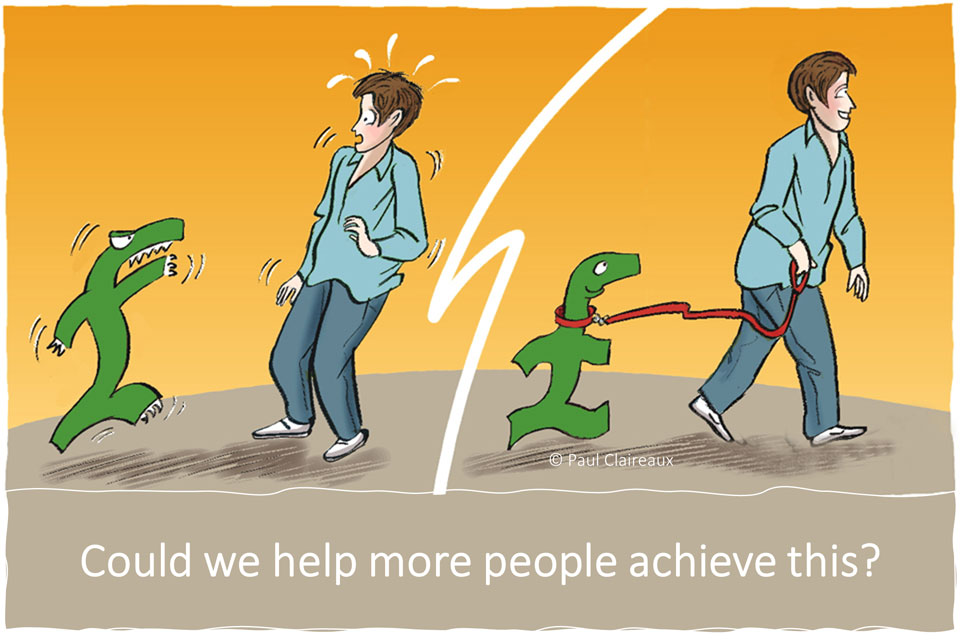

The world needs more good quality (accurate, balanced and compelling) educational content if we’re to make a big dent in the financial literacy gap – and help more people make this transformation in their relationship with their money.

So, please connect with me, via my newsletter or on Social Media, if you’d like to help me put more valuable educational content in the hands of more people.

All the best for now. x