Ten reasons we don’t talk about money.

Could this Insight help your clients, potential clients – and their families and friends?

On this page, I answer six questions:

- What will your audiences learn from these two Insights on ‘Why we don’t talk about money?’

- How will you decide if these Insights are right for your business?

- How evergreen (long-lasting) are these Insights?

- Where in the world can you use these Insights?

- What assets do you receive when you buy a license to use these Insights?

- What’s the cost of this content compared to the cost of creating it in-house?

If you’re new here, read this page first to decide, in general terms, if my content-to-go service could be right for you.

And be sure to sign up for my educator’s newsletter to be the first to hear about new content and updates to existing content.

2. What will your audiences learn from these two Insights?

This series shows how good financial advisers, planners and coaches can help us overcome a range of issues that prevent us from having valuable conversations about money.

So, we explore the reasons why:

- We don’t understand the basics about money.

- We know next to nothing about financial planning – the most valuable service of all.

- We avoid engaging in tasks we don’t understand – which is why education is vital.

- We don’t trust many people in the financial services sector but trust those with no qualifications!

- We wrongly fear we’ll lose control of our money – if we take advice.

- We develop unhelpful beliefs about money and the fact that we can change those beliefs.

- We’re embarrassed to talk about our finances – and why we should not be.

- We may feel we don’t have much control over the money in our family.

- We tend to think that our financial challenges are not a problem for today.

- We wrongly assume that financial planning is simple and common sense.

3. How will you decide if this two-part series is right for you?

Start by reading the two Insights – which start here.

Rest assured that preparing the content for your business will only require minor edits.

You apply your preferred term (‘adviser’ or ‘planner’ or ‘coach’, etc.) and your own call to action to the content, and you’re ready to go.

If you want to make significant changes to this content, please contact me to explore that option before you purchase a license.

Minor changes that do not affect any core message should be fine, but please check with me first if you want to change some of the messages. And please be aware that a highly qualified Chartered Financial Planner has checked (and is happy with) this Insight.

Subject to my availability, we may be able to create derivative versions of this content if you feel you need those.

Just be aware that such custom-made pieces will cost more than this ‘ready-to-use’ content, and we’d need to agree on how we work to create them.

4. How evergreen (long-lasting) are these Insights?

These two Insights will raise awareness of the many reasons people avoid conversations about money – and point a way through those blocks.

So, most of the messages are ‘evergreen’ and will not be affected by changes in tax or interest rates, movements in markets or the winds of change in politics or economics.

In the few areas where updates may be required (to research references, for example), I’ll make those amends and issue the new version free of charge to all license holders.

If you spot any out-of-date information, feel free to notify me, and I’ll update them ASAP.

5. Where in the world can you use these Insights?

Most of the messages in these Insights apply to savers and investors worldwide.

In any event, if you’re a non-UK-based adviser or coach, you may license the content and edit the messages as necessary for your market.

In the future, I hope to partner with a qualified and experienced US-based financial planner to create a US-ready set of these Insights. If that project interests you, please e-mail me at hello@paulclaireaux.com

6. What assets do you receive when you purchase a license?

Once you purchase a license to use this content, you’ll receive an e-mail with a link to a folder containing:

- The series of two consumer-facing educational Insights – with approximately 5,700 carefully crafted words in total. (That’s equivalent to 10% of a typical non-fiction book!)

- 25 high-quality and website-optimised images to bring the Insights to life. Images are essential for boosting engagement and where you choose to present this content as a slide deck within or outside your business.

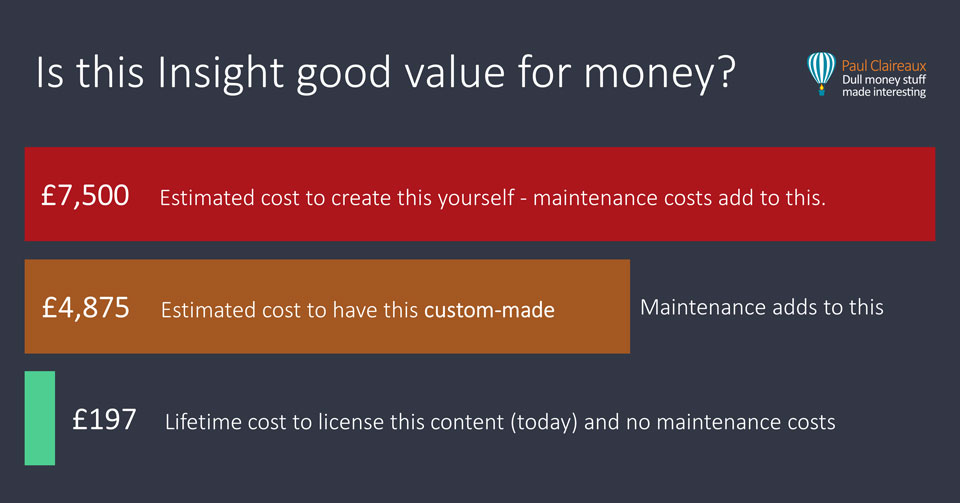

7. What’s the cost of this content versus creating it in-house?

If you have a highly skilled (and financial planning-qualified) writer in-house, they’d need between 25 and 50 hours of intense work to develop ideas like this, research the facts and create these Insights with all the images.

If you have a highly skilled (and financial planning-qualified) writer in-house, they’d need between 25 and 50 hours of intense work to develop ideas like this, research the facts and create these Insights with all the images.

Yes, it might take less (or more!) time, depending on your in-house writer’s skills – and how many drafts are needed before you’re happy with the result.

For your information, I typically create 7 to 10 drafts of my Insights before I’m happy with my work.

Different content creators (like authors and songwriters) work at different paces, and the pace varies between songs, too.

Assuming you charge that person’s time at the average adviser rate of £200 per hour (Source: Vouched For), this content set would cost you between £5,000 and £10,000 to create.

So, I’ll assume a mid-point estimate of £7,500

If you hired a professional writer to create this content, you might save a third of those costs if the writer can create high-quality content faster than your in-house adviser, and their fees are less than those of an adviser – which they generally will be.

Double those estimates for a £400 hourly rate. Halve them for a rate of £100 per hour.

My fee today for a lifetime license to use this content (with free updates) is 97% less than the mid-point estimate cost of creating your own content.

This launch offer price equates to around 1 hour of work for an average financial adviser – and is more than 50% off the normal price for this series of Insights.

This ‘giveaway’ offer is only available to a limited number of firms (worldwide) who license this content – and will be withdrawn without notice.

So, if you feel your clients (or their family and friends) would value this series, please grab this lifetime license now.

The price shown is for firms offering financial advice, planning, or coaching and employing less than eight client-facing staff.

If your firm is larger or you offer other financial services, please e-mail to request a price quote for this license at hello@paulclaireaux.com

Return to the store