How to write a strong news story

but why reading those stories can mislead you

What makes for a strong news story?

In this Insight, I’ll share what a media trainer told me about that.

I’ll also offer my own views on how the ‘strong news’ approach creates misleading and potentially harmful stories about money, investing and pensions and what you can do about it.

A strong story needs one of three things

If you look closely at any news story (in the papers, online, or on mainstream TV, or Radio) you’ll see that it follows one, or more, of three themes:

If you look closely at any news story (in the papers, online, or on mainstream TV, or Radio) you’ll see that it follows one, or more, of three themes:

First, the story might outline a conflict – between individuals, or groups; the good and evil players, if you like.

The press doesn’t always take sides in these conflicts. Although, on personal finance stories, you’ll often find that a bank, insurer, or adviser is positioned as the oppressor.

You and I (the readers) are then invited to be the victims, or potential victims, of the wrongdoer in the story.

Second, a strong news story will often include a case study or two – to illustrate how the victim has been hurt. So, for example, you might hear about (and invariably see pictures of) ‘Jenny and Phil and their two lovely children from Weston Super Mare’ who were ripped off by a nasty bank, or insurer.

Boo 🙁

Don’t Google that story, by the way, I made it up to make the point!

Third, you’ll find that the story is quite different from what you’d expect to be normal.

A strong news story needs to have an ‘edge’ to it. It needs to illustrate an extreme case to grab your attention if it’s to make it past the editor’s cut: for example, “Man bites dog” is far more likely to make the news than the more typical, painful scenario 🙂

Background noise – doesn’t make the news

So far, so obvious, you might think, until you consider how the news latches on to particular stories of human disaster.

So far, so obvious, you might think, until you consider how the news latches on to particular stories of human disaster.

You’ll have noticed how one story of a random but tragic death (or another human crisis – like a missing child) can run for months if not years in our News.

A tragic death from a Terrorist attack might also be in the news for weeks, especially if Donald Trump chooses to impose random immigration controls as a result.

You’re very unlikely to ever be reminded that you’re:

- 407,000 times more likely to die in a motor vehicle incident or

- 6.9 million times more likely to die from cancer or heart disease

The fact that thousands of people die needlessly worldwide every day gets little or no coverage at all.

Did you know, for example, that more than 100 people in the UK commit suicide every week?

The simple truth is that the media don’t highlight these important truths about the world because they’re not extreme, singular events.

They’re not ‘NEW’, so they’re not considered to be strong news stories.

To the media, the challenges faced by ordinary people every day are just too boring.

‘Boring’ doesn’t sell papers… or produce the ‘clicks’ the publishers need, to drive their viewer numbers and sell their advertising.

What’s clear, in our super noisy, on-all-the-time world is that the media’s appetite for ‘edgy’ stories is getting stronger all the time.

Journalists are measured, in part, on their ‘click’ numbers – a fact that a National Newspaper Journalist confirmed to me (at a ‘meet the press’ evening) last year.

They’re fighting a constant battle for our attention – where the winner is the one who can interrupt our finger scrolling habit!

Did the image on this blog interrupt your scrolling? Obviously, it was intended to.

The difference here is that I’m not trying to sell you any products – financial or otherwise. This site is about education pure and simple.

Why this matters for your money…

What has this got to do with your money?

Well, without question this obsession with ‘edgy’ stories affects people’s decisions on what they do about their long-term wealth.

If you want to make better decisions about your money, you need a clear understanding of the issues, but how can you gain that, if you’re bombarded with poor quality or misleading stories (or advertisements) every day?

You’re more likely to make bad decisions… or fail to make any decisions on your important life goals.

And, as you ‘tune out’, discussions about money might even become a joke or a scary, ‘no-go’ area for you.

This is not a joke though, is it?

Making bad decisions about money can cost you tens or hundreds of thousands of pounds over the long term.

What can we do about it?

Well, I’m doing everything I can; I’m committing my life to bringing you solid information… and to exposing the misleading nonsense – whether it’s written deliberately, or through ignorance, as I know is the case in many personal finance articles.

However, this is an enormous job and whilst I can strike a ‘misleader’ down, like a ‘Nightwalker’ in Game of Thrones, it’s likely to get up and come at you again with ever more twisted views!

Great series that, BTW!

https://youtu.be/E6k75pIr3t0

Getting back to the real world, you must decide what to do, to protect yourself from misleading information because there’s a ton of it out there – and a good deal of it gets published in the daily rags.

You must decide who to follow for technically correct and unbiased money guidance; for help in separating the facts from the fiction.

You need to decide ‘Who you can REALLY trust about money?’ and a good place to start is with the person who wrote the book on that question 🙂

In defence of the journalists

Look, there’s no question that some news and other ‘information’ outlets do a great job on some subjects some of the time.

However, even the ‘award-winning’ broadsheets make quite regular mistakes on their stories around money matters. I keep a few records of those.

Whilst many of the ‘big-circulation’ outlets get large parts of their personal finance stories wrong, much of the time. And that’s actually doing a lot of harm.

The question is why?

Well, some mistakes occur because certain money issues are horribly complex – especially around questions of tax, investment and pension planning.

Indeed, some of the complexities around the flawed design of our pensions tax rules are off the scale. Even the experts can’t agree on the answers to some of those questions. This issue is actually crippling the NHS at the moment – read more here if you’re interested in that.

So, to my mind, you need to have studied (and passed) a core set of financial adviser exams if you’re to stand any chance of writing accurately on pensions, tax and investment issues.

Now, I know many journalists don’t agree with that – but it’s interesting to note that Merryn Somerset-Webb (writer for the FT and editor in chief at Money Week) took up that challenge (set by Financial Advisers) and has passed a number of those exams.

I’d love to know which other financial journalists have done the same?

The problem with cautious experts

Beyond this, all journalists face a further problem when writing on their favourite scary financial story.

This is the one about the unaffordable cost of funding a decent pension

Here’s my video take on the issue

The journalist will, of course, look for that ‘attention-grabbing’ headline but, in pension planning, you’d expect them to be constrained by the facts (the numbers) they receive from financial ‘experts’, right?

It turns out that the expert input the journalists receive often creates, rather than blunts, the shock-horror story.

Let me explain.

At the heart of this issue is the fact that most financial experts, understandably, fear getting into trouble with their financial regulator.

If you upset the Financial Conduct Authority (FCA) too much, you’ll soon be out of business, and one way to seriously upset the FCA is to make overly optimistic projections about future investment returns.

So, the experts tend not to do that!

Instead, they supply journalists with pension cost numbers based on cautious assumptions about the future.

First, they’re cautious about future investment returns.

Second, they assume pension savers will buy inflation proofed income at retirement… despite the fact that most people do not buy inflation proofed annuities, they buy level income versions.

In short, the experts’ cautious assumptions are like assuming we all live in a perfect world – where everyone can afford to save for a Rolls Royce (inflation proofed) type of pension.

They ignore the inconvenient truth that most people (who aren’t accruing defined benefit pensions) can’t afford that type of car!

Save yourself thousands of hours of time

In summary then:

1. Too many ‘stories’ about money (in newspapers and elsewhere) contain factual errors, and

2. The ‘cost of a pension’ horror stories will just keep coming whilst ‘experts’ deliver overly cautious numbers to journalists.

So, be careful who you follow for Insights around money.

Focus your reading on the best – and cut out the rest.

Which reminds me of the famous John West adverts… remember those?

Try this very alternative version, it’s worth a look.

Anyway, if you do cut out the rest, you’ll save yourself thousands of hours of reading (and a ton of confusion) in the future.

Remember also – you’re different to others

This is a critically important lesson… and it’s perhaps the most important lesson I can offer you.

Why?

Well, those personal stories – the ones you see in the press – of how Phil or Sara did well (or badly) with this or that investment… they really don’t help you.

Sure, they might make for a strong news story.

They might even, occasionally, reveal a useful idea to follow up or a risk to watch out for.

However, most of those stories simply add more noise to what some see as a scary and confusing picture around money.

Learn the fundamentals around money

So, the only (good) answer I see to our financial challenges is to learn the fundamentals around money – and it’s really not that difficult if you follow the right people… 😉

Learning the fundamentals is a vastly better thing to do – than reading dozens of the latest, shock horror, personal finance stories.

Once you’ve ‘got’ the fundamentals, you’re equipped to make better choices for yourself.

If you want to enjoy the freedom of having a car, you need to learn to drive, right?

Well, the same applies if you want to enjoy the freedom that could come if you have some money.

You just need to learn a little about how to manage and protect it.

After all, not everyone can afford a Chauffeur/ Wealth manager… and not all Chauffeurs are excellent drivers either – but that’s another story.

Now here are the fundamentals I think you should learn:

- How to draw up a sensible plan for your money – for the long term – and on one sheet of paper.

- How to choose the right financial products for your particular needs and

- How to access financial products and advice at a sensible price.

This is the real-life stuff about money that we all need to know – but they don’t teach at school…

They don’t even teach it at business school, which is crazy, isn’t it?

What’s the best place to learn?

Well obviously, right here is a great place to start 🙂

Yes, I might be a teeny bit biased but I honestly don’t think you’ll find a better and safer place to learn about money – because I’m qualified to write on this stuff and my work is acclaimed by others who are highly experienced and qualified also.

Anyway, you don’t want to hear me bragging here. You can find out more about me on my about page – or by connecting on LinkedIn

The other thing that might surprise you is that I don’t sell financial products.

So, you don’t need to worry about that. My work is about education, pure and simple.

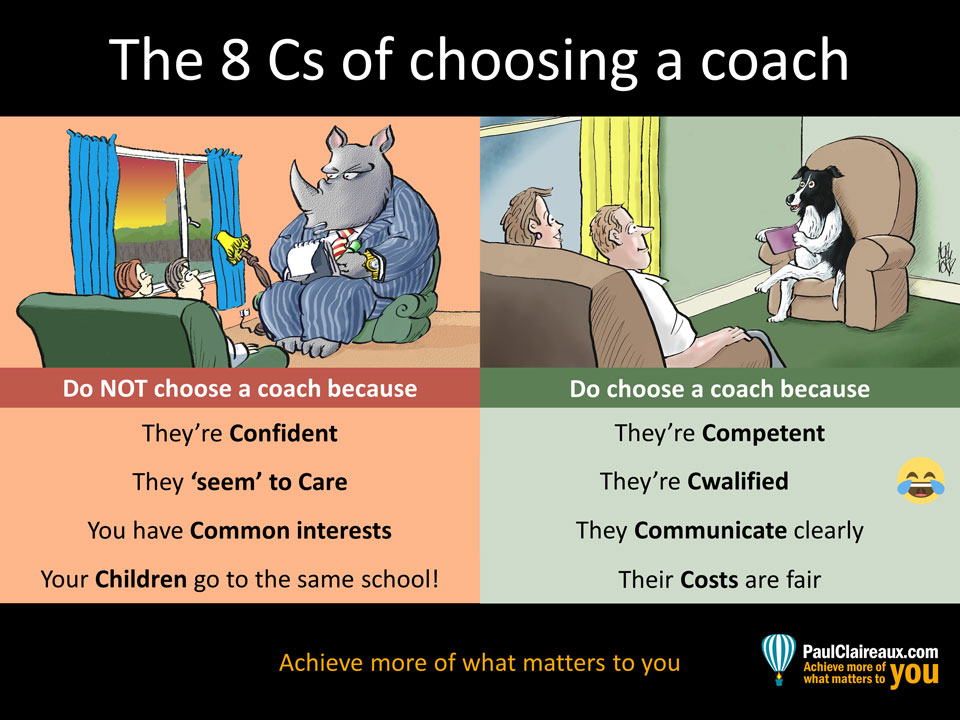

If you’d like to continue your learning journey, just follow me on Twitter or sign up to my very occasional newsletter, and whoever you choose to learn from – use this checklist.

Of course, you might think that I’m having some fun here – and I am. Having fun is important in learning, but I’m deadly serious about those checks.

From time to time, we all make the dangerous mistake of choosing a coach or mentor because of their confidence… or because of how well, we think, we know them.

It is nice to know a person but what matters more is: what that person knows.

So, choose your coach or educator carefully.

Find someone who is competent and communicates but doesn’t charge the earth.

Do that and you won’t go far wrong.

Final thought. Never mind the Press, what about YOUR writing?

I guess I’ve given the press a bit of ‘hard time’ about their financial planning articles – and those criticisms stand.

However, when it comes to their approach to getting your attention, you might want to take a leaf out of their book – especially if you write for your business or you’re trying to build your reputation as a thought leader.

We all aim to write great content. Sometimes we manage it, sometimes not so well, but it’s all a waste of time unless people read our work and for that, you have to ‘play the game’.

You too, have to grab and hold people’s attention.

So, think about how to create a strong news story or two of your own – by introducing a bit more conflict, some case studies or curiosities.

Did you notice the conflict in this article?

Sure you did;

this story is about you and me, fighting gainst the ‘misleaders’ in the world…

and this battle will continue!

If you found this interesting and would like more Insights into writing, sign up for my newsletter; I’m developing a new series on various aspects of that.

Thanks for dropping in

Paul

For more ideas to achieve more in your life and make more of your money, sign up to my newsletter and, as a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ and the first chapter of my book, ‘Who misleads you about money?’ What’s not to like?

Feel free to share your thoughts in the comments below

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article