Could you treble your money?

by earning just 4% extra each year?

Just a short Insight on how little extra returns could grow into almighty profits provided you have time on your side … and you invest when markets are fair value.

The numbers in bumpy times

Here’s an interesting little fact

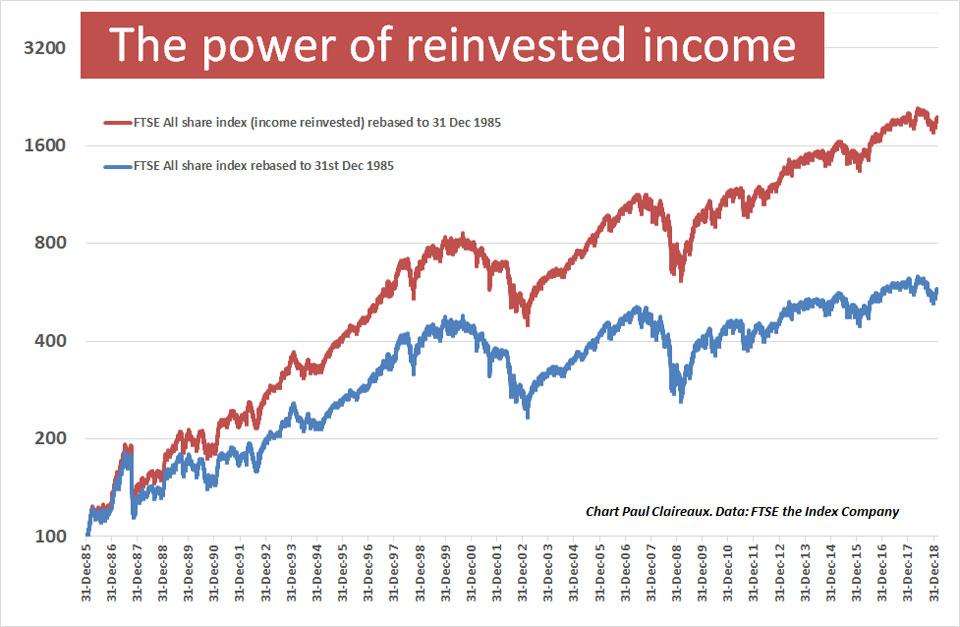

Over the 33 years from the end of 1985 to the end of 2018 …

… the UK stock market (as described by the FTSE All Share index) has grown, on average, by 5.2% each year*

* Now, this return is before charges have been deducted:

- for the fund

- for the platform, you keep it on and

- for any associated advice, you’ve had around it.

It’s also what’s called a ‘nominal’ return which means it takes no account of inflation which averaged 3.35% p.a. (on the retail prices index) over this period

So, your personal return, net of charges and after inflation, would have been closer to zero each year.

And that sounds very disappointing, right?

You might achieve that by leaving your money in the bank

Yes, you might. It’s a similar (near zero) real (after inflation) return that you might expect from bank savings over the long term.

The difference here though is that you’d need to reinvest your income (the interest) on your bank savings along the way, to break even (or thereabouts) with inflation. Your capital doesn’t grow at all in banks.

Reinvest your stockmarket income

But what if you reinvested the income (the dividends) from a stock market fund?

How would that have affected your return?

Well, it would have pushed up that (before charges) nominal return from just 5.2% p.a. to around 9.2% p.a.

So, after deducting charges, your after-inflation return would have been around 4% p.a.

4% a year … is that all?

OK, so, I know that 4% p.a. doesn’t sound exciting but, as you can see here, over the long term, this can add up to a lot of extra return.

And over this, most recent, 33 year period, you’d have built up a fund of about three and a half times as much with a stock market linked investment than holding your money in a bank savings account.

That’s also three and half times what you’d have got from a stock market linked investment fund but had taken out the income along the way. Remember, developed stock market prices alone (without the power of reinvested income) tend to produce similar returns to bank savings over the long term.

No cushion short term

We can quite clearly see that, on stock market-linked investments, reinvesting your income seriously boosts your returns over the long run.

But over the short term, and especially if you invest at a very high (valuation) point in the market cycle (when the income yield from shares might is typically very low) this reinvested income only provides a thin cushion.

So, for example.

Had you been unlucky enough to have joined the throngs of people buying investment funds around January 2000, then by March 2003, your fund, even with reinvested income, would have been down by around 46% (and even more after charges) …

… which is not much better than the All-share index without reinvested income over the same time. That fell by 51%.

Conclusion

If you’re a long term growth investor then, of course, you’ll want to buy funds that reinvest your income to enhance your returns.

And you can expect those small reinvested income amounts to make an enormous difference over time when compared to holding funds and taking out the income along the way.

However, you still need to be mindful of the timing risks in markets … at least at times 😉

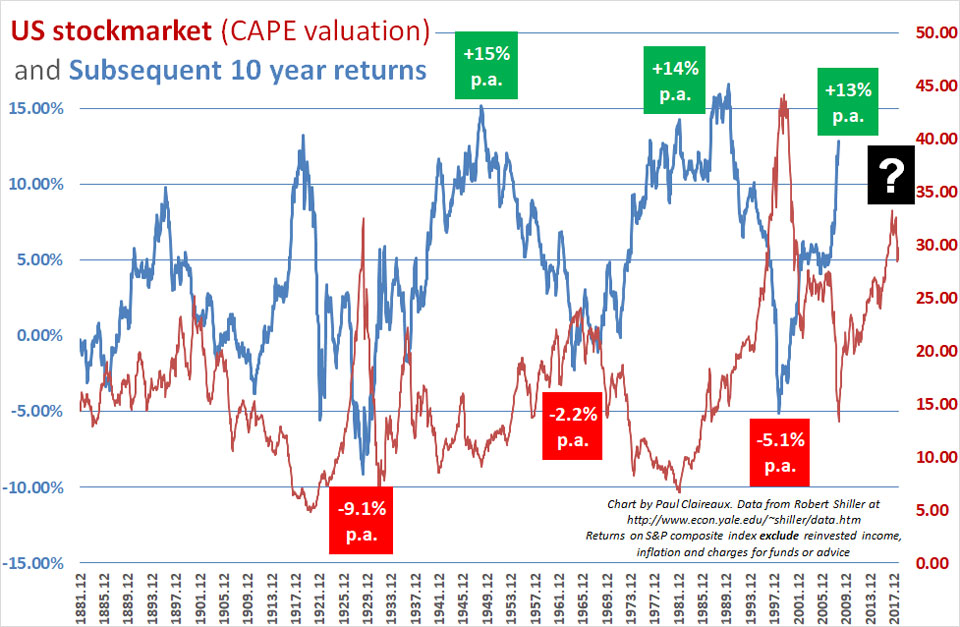

The plain truth is that sometimes markets are a lot more expensive than others as we’ve seen many times on this site.

So, it’s worth at least considering the idea of spreading your investments over time when a key, long term, indicators (like CAPE) suggest that the world’s largest stock market is very expensive by historical standards.

Currently (March 2019) several leading fund managers are making the case that the UK stock market offers better value than the US (on which that CAPE indicator is based) … but if you invest in funds that spread your investments across most world stock markets in line with market capitalisations, you will get a belly full of US stocks right now.

And, either way, if US stocks do catch another cold – as they briefly did at the end of last year – it seems unlikely that UK stocks could escape unscathed.

So, now is a good time to take more notice of valuations than you might have done before.

And if you use an adviser, make sure they’re doing so too.

After very long runs in bull markets, everyone can get lulled into thinking that markets go up forever. They don’t.

So, take care out there

Paul

Thanks for dropping in …

… if you’d like more ideas around money and personal performance, in an occasional newsletter, sign up here.

And, as a thank you, I’ll send you my ‘5 Steps for planning your Financial Freedom’ … and the first chapter of my book, ‘Who misleads you about money?’

Or, if you’d like more frequent ideas (and more interaction) …

And feel free to share your thoughts in the comments below.

You can comment as a guest (just tick that box) or log in with your social media or DISQUS account.

Discuss this article