How do you make an awesome financial plan?

Familiar with my services?

If you are, and you’re happy that this particular lifetime license is right for your business, click here to buy that license now

Have you considered my NEW ‘All Insights Pass’?

If you’re new here, consider my ‘All Insights Pass’ before you buy this single Insight license.

The All Insights Pass allows you to use all of my current and future Insights in your business, in exchange for one low monthly fee.

And, as with all my licensed Insights, the content updates and upgrades are included in that fee.

What’s covered on this page?

For this series of Insights on: ‘How to make an awesome financial plan’, I’ll answer six questions:

- Why might you want to use this series – or something similar?

- How could this content help your business?

- Are these Insights Evergreen? Will they last a long time?

- Can you use these Insights outside of the UK?

- What assets do you receive when you license this series?

- How much could this license save you on the cost of creating similar content in-house?

If you have other questions (about this series or my services in general) please email me at: hello@paulclaireaux.com or book directly into my diary here.

1. Why might you want to use these Insights?

You and I know that financial planning is the most valuable of all Financial Services.

The problem is that most people don’t know this!

For information, the blue line is also on the floor when we swap ‘financial planning’ for ‘financial advice’ as a search term—and when we run the numbers for the UK or the USA alone.

This suggests that the £/$ billions spent on marketing by the financial services sector have done nothing to boost consumer awareness of financial planning.

Indeed, it seems to have take us backwards over the past 20 years!

Then there’s research (from Schroders, UK, and Cerrulli, USA) showing that up to 70% of the inheritors (spouses or adult children) of wealthy advised clients plan to leave the current adviser after the wealth holder dies.

These are enormous issues for advice firms that want to attract or retain more clients.

Consumers clearly need vastly more engaging explanations of financial planning—and that’s what this series offers.

To be clear, I know some advice firms who do a brilliant job of this. However, too often we see firms describe their core service with a list that looks something like this.

Does this sort of description inspire potential clients to ask for advice?

Does it help the firms that use it to stand out?

Or does it position them in a dull grey sea of sameness?

Of course, most firms will use a few more words than those in their service-promoting page.

And many firms provide a lot more detail in a service description document, but how many of those use warm, consumer-friendly language?

I see a lot that are cold and business-process-focused.

I’m sorry if this sounds critical. It’s just that I’m passionate about the value of good financial planning.

My work is about helping firms lift that blue line of awareness off the floor.

And I know we can do this.

The landscape for advice is changing now, too.

As you know, the NEW super-low-cost targeted support services will arrive in 2026, which makes it essential to explain the value of full financial planning.

Most (non-advised) people don’t see the immense value (and fun) in a full financial planning service.

Yet, research from Psychologists proves that we engage more in complex tasks (like financial planning) when we understand the process – and acquire a sense that we have some capability in those tasks.

People who know nothing about driving a car, thankfully, don’t tend to jump into the drivers seat!

So, we need to reposition financial planning away from that dull grey list to a process (that all good planners follow) where clients feel happy to take the driving seat of their own financial lives – with you as their driving instructor.

And these Insights are designed to do precisely that.

They offer an inspiring and unforgettable explanation of financial planning – so you can attract, engage and retain more clients.

The key to success with this (and all questions on financial planning) is to explore the process entirely through the consumers’ eyes.

2. What will your audiences learn from this series of insights?

The best way to answer that question is to read the series ‘How to build an awesome financial plan’

In short, the series wakes people up to the value of financial planning by answering these questions:

- Why is financial planning a secret?

- What are the four causes of our chronic financial literacy problem?

- How do #finfluencers mislead people with their random (unqualified) tips on social media?

- With shocking research to show that the ‘influencers’ who give money-losing tips tend to have the most followers!

- What do people do instead of planning their money?

- What types of life events tend to prompt people to seek advice?

- What are the potentially devastating life events that we must deal with as a priority?

- What are the three reasons we must learn (the basics of) how to plan our money? (This draws on research from the acclaimed psychologist Albert Bandura)

- What are the dynamics of financial planning for couples and families?

- What phrases can help us remember what financial planning offers us – and our loved ones?

- Why is this all about finding and achieving more of ‘What really matters to you‘?

- Why is financial planning not common sense, despite what many tell us?

- How can we remember the financial planning process in seven AWESOME steps?

- How could we start our financial life plan with pictures on one sheet of paper?

The conclusion, as always, is that your professional guidance is vital.

What are the seven awesome steps?

Read the series to find out, and decide if you like how the steps are explained.

If you do, you can purchase the license to use the content immediately.

Alternatively, if you like the ideas in this series but think you’d like to offer:

- A unique version (with a NEW acronym) tailored for your business.

- A longer series of shorter posts.

Let’s meet online and find a way to create similar works for your business.

(I have a PIRATE acronym ready, or we could develop another if you prefer)

2. How could this Insight help your business?

By sharing compelling and audience-relevant educational Insights, you:

- Demonstrate your warmth and competence (which is proven to build trust) before you meet potential clients.

- Generate more suitable enquiries for your services.

- Reduce the need for costly push marketing activities, such as advertising.

- Save yourself (and clients) valuable time at the onboarding, advice and review stages of your service.

- Raise your prospects’ awareness of the value of your services.

- Minimise some key business risks.

In fact, there are 25 general benefits of education-first marketing, all listed here.

And those are on top of the benefits to your audiences of grasping the particular concepts in this series.

This series will bring (or keep) your audiences close to YOU by giving them more Insights into how they would engage with the financial planning process, and the value of your coaching, guidance and advice.

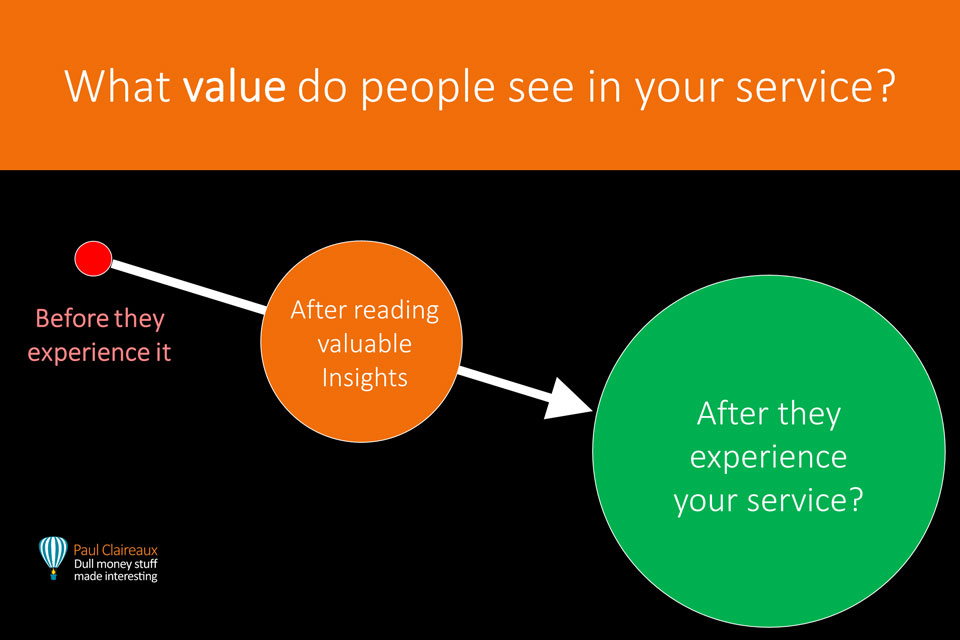

This is what all my Insights are designed to do – as shown here.

3. How could you use this Insight series in your business?

After buying this license, you’ll have immediate access to the text and image files, and you’re then free to:

- Produce the Insight in multiple formats: blog posts, presentation slide decks, videos, or PDF guides as downloadable lead magnets.

- Apply your firm’s formatting style, colours, logo, etc.

- Describe your role (planner, adviser, coach, wealth manager, etc.) in your preferred way.

- Remove or change the images if needed – provided this does not change the messages. I suggest you use in-post images, because they significantly boost engagement.

- Add your own ‘call to action’ messages to direct readers to seek your help in your preferred way – via telephone, e-mail, chatbot, or enquiry form.

- Remove any links to related Insights – if you don’t wish to offer those.

- Add a regulatory warning if your compliance manager says it’s necessary. Just remember that these insights are all generic education. They are not financial promotions, so they should be exempt.

Instructions on preparing these Insights for use in your business are included with the pack you download after purchasing the license.

Do you need *custom-made* content for your business?

If you believe you might want to change this Insight, please book a meeting to discuss this before purchasing a license.

Image changes that do not affect any message should be OK, but please check with me first if you want to change any messages in this content.

I spend an enormous amount of time researching and creating these Insights, which have been checked by a highly qualified financial planner who used to mark the Institute of Financial Planning (now CISI) exam papers.

So, this Insight is not a rough draft. And I want to protect your reputation (and mine) by maintaining the integrity (accuracy and balance) of this content.

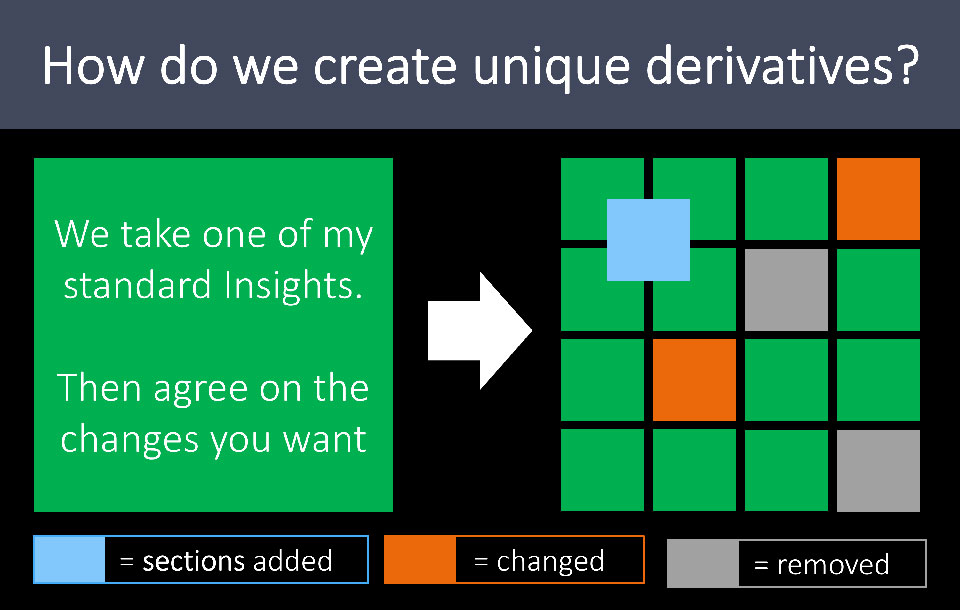

I’m happy to discuss working with you to create custom-made works, including unique derivative versions of any Insights I offer now—or plan to offer in the future.

Derivative works give you the best of both worlds.

The insights are tailored to your needs and ideas, but you can still save 50% to 85% on the cost of creating similar content in-house.

And creating these unique derivative works can be a simple process:

We’d just need to meet online to agree on how we would work together.

So book a meeting here if you’d like to do that.

3. How evergreen (long-lasting) is this Insight?

Most of the messages in this Insight are Evergreen, so they will not be affected by changes in tax or interest rates, stock market prices, or the winds of political or economic change!

In the few areas where updates may be required, I’ll amend the Insight and issue the new version free of charge to all license holders.

If you spot any information that you feel needs updating, feel free to notify me, and I’ll update those points ASAP.

I may also enhance this Insight in the future, and such upgrades will also be made available to all license holders free of charge.

4. Where in the world can you use this Insight?

This Insight is designed to help financial planners, advisers, and coaches attract, engage and retain financial planning clients worldwide.

If you’re a non-UK-based adviser or coach, you may license the content and edit any financial product or tax messages where necessary.

In the future, I hope to partner with a qualified and experienced US-based financial planner to create a US-ready set of all my other Insights.

If that project interests you, please e-mail me at hello@paulclaireaux.com

5. What content assets will you receive?

After licensing this content, you’ll be sent a link to download this series, which comprises:

- c. 8,000 carefully crafted words – that’s 12% of a good-sized non-fiction book!

- 33 high-quality and website-optimised images to bring the Insights to life.

Images are essential for boosting engagement, whether you offer this content as written guides, blog posts, or as an educational slide deck for training your team or briefing prospective clients.

6. How much could you save with this lifetime license?

I’ve priced this lifetime license to save you between 90% and 95% of the cost of creating content (of similar depth and quality) in-house.

This assumes you employ a highly skilled (and financial planning-qualified) writer, and you account for their time at the average adviser rate of £200 per hour (Source: Vouched For)

Realistically, your in-house writer would need between 40 and 80 hours of intense work to create a finished Insight like this one.

So, this series would cost you between £8,000 and £16,000 to create in-house!

I’ve used the midpoint of £12,000 in the image above.

Double those cost estimates if your writer can earn £400 per hour on other work. Halve them if their earnings rate is £100 per hour.

I’ve outlined why it takes so much time to create high-quality Insights in this other post.

Content creators (like authors and songwriters) work at different paces, and the pace varies with the complexity and length of the lessons.

Deeper works are vastly more engaging to your audiences for reasons I explored here.

However, what surprises people is that longer works take disproportionately longer to write!

Deep Insights take longer to produce because (like writing a book) you have the challenge of content structuring and ordering the various sections (to achieve a nice ‘flow’), in addition to the work of crafting each message.

For example, this Insight on ‘How to build an awesome financial plan’ took me 75 hours of intense effort to create.

The good news, however, is that this lifetime license enables everyone in your firm to use this Insight (with free updates) for a single fee that one average adviser could earn in under 3 hours!

Does that sound like a good price?

The price shown here is for smaller advice firms.

The lifetime license price on the button below applies to firms offering financial advice, planning, or coaching and employing less than eight client-facing staff.

If your firm is larger than this or you offer other financial services, please ask me to quote you a price for this license at hello@paulclaireaux.com

This license price is slightly higher for larger firms. However, I’ve designed the pricing to ensure that larger firms still pay less (per adviser) than smaller firms.

Should you try before you buy?

On this page, you’ve learned about the benefits and costs of using one of my licensable series of Insights.

Before you license it, however, be sure to check out my NEW ‘All Insights Pass’, which gives you access to all my current and future Insights for a low monthly fee.

I don’t mind which option you choose, as long as it offers great value to your business.

Do you need help to decide?

This bar chart offers realistic estimates of the range of costs to build or acquire a sound Insights library.

I’m happy to help you explore these options on a video call.

And I’m keen to ensure you get the best deal possible for your business from me or any content creator you work with.

If you’d like to do that, book a meeting directly into my diary here.

Happy to license this Insight?

If you’d like to use this Insight on ‘How to make an awesome financial plan’ in your business, purchase the lifetime license (with FREE updates) here now.

Return to the store